Where the dollar and gold are concerned, 10 o'clock eastern time is key. That's when the Institute of Supply Management (ISM) is due to report its index of business activity. Similar to the PMI

's index, the ISM index is a diffusion index where readings above 50 indicate expansion; under 50 contraction, or trouble. And similar to yesterday's ISM, economists are predicting a slight rise in the ISM to 52. But that's where the bulls are hoping the similarities end since everyone was surprised by a slide in the PMI to below the 50 demarcation line. IF the ISM index surprises to the downside, the dollar's slide will resume and gold will rally further. This morning both are holding fairly steady with gold down 3-tenths of a percent and March Euro futures holding at around $1.33.

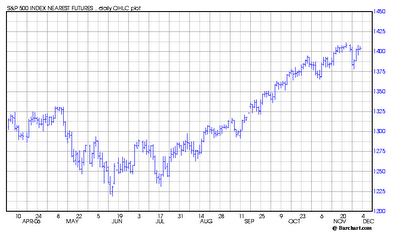

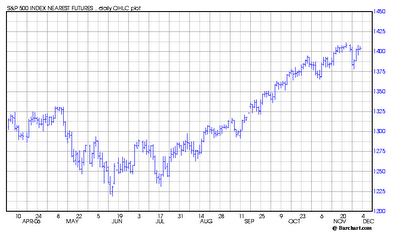

The stock market pretty much shrugged off the ISM data with modest declines after a data sparked morning

selloff. The chart below of December S&P futures shows it's getting closer to the highs of the year again, and that certainly may be a resistance point for the bulls.

No comments:

Post a Comment