Jan Hatzius of $GS fame sees QE 3 coming during the first half of 2012.

That's what this blog has been saying would happen for quite some time. Expect some pain and plenty of volatility, and up days too, like today before the real QE3 curtain is opened. It will be Maloox country with out a doubt on Wall Street.

Ok, so what does this mean from an investing perspective? It will empower traders once again to bid up shares of stocks. So I would not be surprised to see a fairly large rally for Spring 2012 provided that the world is not turned completely upside down before that point.

Natually, this will help the metals, GOLD in particular. There will be many fools who will not listen and act again. The time is now to be accumulating gold. QE3 is the fuel that is needed to blast the FED into an orbit of unlimited printing. This can only help gold. $2000 gold looks like a stretch for 2011, but it sure looks like a sure bet for 2012 if Jan is right, and again, there hasn't been systemic failure.

Wednesday, November 30, 2011

$$ Wednesday 11/20 Trading Desk Color

Our source at broad and Wall emails us with this account of trading desk activity

Desk color: risk-on day. Early on, there was a lot of covering

but some (small) vanilla buying is starting to emerge as we head into the

afternoon. The sentiment remains skeptical, w/many people poking holes in

today's actions (a lot even think the US$ swap rate cut was in response to

an imminent crisis that regulators were looking to forestall). This is a

change from back in Oct where there was more faith in European

policymakers. All that said, the price action can't be ignored and traders

continue to ask whether we are seeing the start of another Oct-like hope

rally (that one wound up being worth 20%; so far, this one is +7%). There

is some chasing occurring in those names seeing the biggest moves (esp. the

steels/coals) but overall there is very much a macro focus w/people

buying stocks generally and correlations staying very elevated. People are

watching 1250 and then the 200day MA (1265). We are likely to see our 2nd 90% up session in the last 3, recall we had 3 90% down days in 5 session heading into Monday...

Desk color: risk-on day. Early on, there was a lot of covering

but some (small) vanilla buying is starting to emerge as we head into the

afternoon. The sentiment remains skeptical, w/many people poking holes in

today's actions (a lot even think the US$ swap rate cut was in response to

an imminent crisis that regulators were looking to forestall). This is a

change from back in Oct where there was more faith in European

policymakers. All that said, the price action can't be ignored and traders

continue to ask whether we are seeing the start of another Oct-like hope

rally (that one wound up being worth 20%; so far, this one is +7%). There

is some chasing occurring in those names seeing the biggest moves (esp. the

steels/coals) but overall there is very much a macro focus w/people

buying stocks generally and correlations staying very elevated. People are

watching 1250 and then the 200day MA (1265). We are likely to see our 2nd 90% up session in the last 3, recall we had 3 90% down days in 5 session heading into Monday...

11/30 Market Comment: Dow Spike Day!

My Blog: Another Dow Spike Day.... $SPY $FXE $GLD $GC_F $BAC $XLF $ADP # China #Greece #Germany #ECB #EU

The stock market is still captivated by each and every headline that comes from Europe. Yes, the problems there are well known yet all they do (whether the IMF, or various Eurozone officials) is talk. Where’s the concrete action? When action happens I anticipate another leg up in stocks. Blithering and breakup... READ THE REST HERE:

http://stks.co/1Jr2

The stock market is still captivated by each and every headline that comes from Europe. Yes, the problems there are well known yet all they do (whether the IMF, or various Eurozone officials) is talk. Where’s the concrete action? When action happens I anticipate another leg up in stocks. Blithering and breakup... READ THE REST HERE:

http://stks.co/1Jr2

Tuesday, November 29, 2011

$AMR

Hmm, should I get a gum ball with my quarter, or a share of $AMR? That's my two cents on the issue (where the stock may end up going). Right now $AMR is wooing in flies like potato salad on a picnic bench in August. What are they expecting? Some sort of miracle? It's not like an employee is going to discover a ton of gold in the lost and found and save the day.

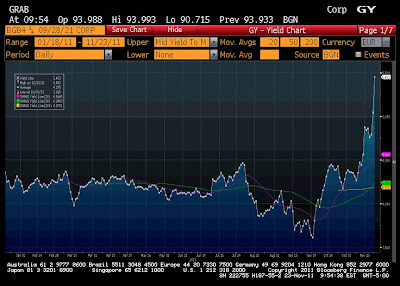

$FXE Bond market always gives Us Clues First

As we are prone to point out. The Bond market always figures out 'stuff' first.

- ECB’s failure to fully sterilize its

SMP bond purchases today indicates a high level of stress as

liqudity is constrained and banks continue to deleverage, Dan

Dorrow, strategist at Faros Trading, writes in note.

• Failed sterilization shows banks prefering to hold O/n cash than tie up deposits for 1 wk at ECB’s auction: Faros

• The high bank liquidity demand is consistent with other stress indicators including EUR/USD basis swaps and Euribor/OIS spreads: Faros

• 3-mo EUR/USD basis swap -5.7bps to -154bps; most stressed level since October 2008

• Euribor/OIS spread climbs to 0.95, highest since Nov. 3

• Investor base for peripheral bonds have also disappeared, another sign of euro-zone stress, as Italy’s 3- and 10-yr auction both yielded above 7.5%: Faros

• ECB is less aggressive in addressing credit crunch than Fed

• The slower ECB is to respond, the more it will have to ultimately ease: Faros

• EUR/USD may be pressured lower as ECB replaces non-euro-zone investors base via its SMP purchases; many investors who have left may not return for a few quarters, even with a Troika solution: Faros

• ECB may have to cut rates to new historical lows below 1% and also actively expand balance sheet: Faros

• Easing measures to weigh on EUR/USD: Faros

• EUR/USD +0.1% to $1.3338; off session high of $1.3442 following news of ECB’s failed sterilization: Faros

- ECB’s failure to fully sterilize its

SMP bond purchases today indicates a high level of stress as

liqudity is constrained and banks continue to deleverage, Dan

Dorrow, strategist at Faros Trading, writes in note.

• Failed sterilization shows banks prefering to hold O/n cash than tie up deposits for 1 wk at ECB’s auction: Faros

• The high bank liquidity demand is consistent with other stress indicators including EUR/USD basis swaps and Euribor/OIS spreads: Faros

• 3-mo EUR/USD basis swap -5.7bps to -154bps; most stressed level since October 2008

• Euribor/OIS spread climbs to 0.95, highest since Nov. 3

• Investor base for peripheral bonds have also disappeared, another sign of euro-zone stress, as Italy’s 3- and 10-yr auction both yielded above 7.5%: Faros

• ECB is less aggressive in addressing credit crunch than Fed

• The slower ECB is to respond, the more it will have to ultimately ease: Faros

• EUR/USD may be pressured lower as ECB replaces non-euro-zone investors base via its SMP purchases; many investors who have left may not return for a few quarters, even with a Troika solution: Faros

• ECB may have to cut rates to new historical lows below 1% and also actively expand balance sheet: Faros

• Easing measures to weigh on EUR/USD: Faros

• EUR/USD +0.1% to $1.3338; off session high of $1.3442 following news of ECB’s failed sterilization: Faros

Updated Morning Market comment: including Case Shiller data. More housing Gloom

11/29/11 Morning Market comment The Happy Faces are in for a battle on Wall

Street. Futures have faded from the highs on word that American Airlines parent

AMR has filed for bankruptcy protection. This offsets (you can’t make this stuff

up) news that Italy (more below) managed to complete an auction of 3 and 10...

Read more here: http://bit.ly/urC5LN

Morning Market Comment: Italy, European Developments, $AMR, $Tif Greece, Crude Oil 11/29/11

11/29/11 Morning Market comment The Happy Faces are in for a battle on

Wall Street. Futures have faded from the highs on word that American

Airlines parent AMR has filed for bankruptcy protection. This offsets

(you can’t make this stuff up) news that Italy (more below) managed to

complete an auction of 3 and 10... Read more here: http://bit.ly/urC5LN

Monday, November 28, 2011

Morning Market comment for 11/28/11

My blog is now up after some technical difficulties. $FXE #IMF $SPY $WMT $TGT $M $ANF $AAPL #Italy #Greece #Germany http://stks.co/1HtL

Thursday, November 24, 2011

$$ SocGen Sues a Newspaper For "Disaster" Article

Read Here from CNBC.com http://soc.li/g6HOkrF. The Daily Mail of the UK is being sued by the French banking giant Societe Generale for an article published in August. The paper claimed Soc Gen was on the verge of crumbling. Curiously, the Mail should be responding with guns a blazin', but instead is cowering in a corner.

The truth is that banks have been and are in horrible shape. What is the Mail apologizing for? For US banks, it's clear that shoddy, but legal FASB accounting practices have amounted to these banks having two sets of books a la the worst ponzi and cheating schemes of all time - worse than Bernie Madoff, or even Mr. Ponzi himself. European banks are stuck with a pile of debt that is on the way to becoming huge write downs that will cause them to collapse one by one.

The Mail's biggest mistake? They should have spent a little more time to dig a little deeper and come up with better sourcing for their claims. They would have found it.

Banks have only themselves to blame for their emasculated share prices, the distrust of the people, and the move by people to consider the mattress as a safer alternative to deposit their money. SocGen sounds ridiculous when it claims it has suffered "substantial damage to its reputation and prejudice to its trade.”

I find the suit offensive. It wreaks of the wrath of the banking establishment coming down on a newspaper for saying the wrong things (in the view of the banks). The banking PC way to go is with the meme - 'that we have it all under control' when in reality the banks are actually INsolvent. True, the Mail is often over the top with its news coverage style, selection of stories, interviews, etc., but the Mail is not the authority of the financial world, yet its dose of wake up to its masses readership elicited quite a response. This is not what the banks want. The banks will stop at nothing to advance their all is ok reality. The Daily Mail did what amounts to a big no-no for giving the masses a hint, or two about what is really going on. For the banking cartel, that Freedom of the Price concept is dangerous.

Even the most clueless must know that banks are still replete with bad assets that date back to a vintage that caused the 2008 financial crisis. Banks are reviled for receiving billions to trillions (the numbers are so big that an exact figure is debatable but still so large that it cannot be fathomed and is thus abstract except to say it was obscene) in government bailout money for taking risks that would make the best of the gamblers in Atlantic City turn red. The MF debacle has already scared many and has caused another leap in distrust of "banks". Stupid ideas like $5 ATM fees haven't helped. And let's not forget, the chief bankers behind their rape of society are still walking around in $2000 tailored suits.

If you don't think this stuff isn't going on European banking circles, I have a bridge to sell ya. Banks around the globe have killed their own reputations.

The debt situation in Europe has long been festering. The first Greek bailout took place months before the Mail's August article. By implication of the growing problems that were all too clear by August (without the sensationalist news coverage the Mail is known for providing), banks were a marked lot -- marked for troubles.

Not that I'm a fan of the Daily Mail, but it is stupid for it to back down so quickly.

The truth is that banks have been and are in horrible shape. What is the Mail apologizing for? For US banks, it's clear that shoddy, but legal FASB accounting practices have amounted to these banks having two sets of books a la the worst ponzi and cheating schemes of all time - worse than Bernie Madoff, or even Mr. Ponzi himself. European banks are stuck with a pile of debt that is on the way to becoming huge write downs that will cause them to collapse one by one.

The Mail's biggest mistake? They should have spent a little more time to dig a little deeper and come up with better sourcing for their claims. They would have found it.

Banks have only themselves to blame for their emasculated share prices, the distrust of the people, and the move by people to consider the mattress as a safer alternative to deposit their money. SocGen sounds ridiculous when it claims it has suffered "substantial damage to its reputation and prejudice to its trade.”

I find the suit offensive. It wreaks of the wrath of the banking establishment coming down on a newspaper for saying the wrong things (in the view of the banks). The banking PC way to go is with the meme - 'that we have it all under control' when in reality the banks are actually INsolvent. True, the Mail is often over the top with its news coverage style, selection of stories, interviews, etc., but the Mail is not the authority of the financial world, yet its dose of wake up to its masses readership elicited quite a response. This is not what the banks want. The banks will stop at nothing to advance their all is ok reality. The Daily Mail did what amounts to a big no-no for giving the masses a hint, or two about what is really going on. For the banking cartel, that Freedom of the Price concept is dangerous.

Even the most clueless must know that banks are still replete with bad assets that date back to a vintage that caused the 2008 financial crisis. Banks are reviled for receiving billions to trillions (the numbers are so big that an exact figure is debatable but still so large that it cannot be fathomed and is thus abstract except to say it was obscene) in government bailout money for taking risks that would make the best of the gamblers in Atlantic City turn red. The MF debacle has already scared many and has caused another leap in distrust of "banks". Stupid ideas like $5 ATM fees haven't helped. And let's not forget, the chief bankers behind their rape of society are still walking around in $2000 tailored suits.

If you don't think this stuff isn't going on European banking circles, I have a bridge to sell ya. Banks around the globe have killed their own reputations.

The debt situation in Europe has long been festering. The first Greek bailout took place months before the Mail's August article. By implication of the growing problems that were all too clear by August (without the sensationalist news coverage the Mail is known for providing), banks were a marked lot -- marked for troubles.

Not that I'm a fan of the Daily Mail, but it is stupid for it to back down so quickly.

Wednesday, November 23, 2011

Bunds; Stress; Groupon; MF; Tis the Season; Data Dump

11/23/11

German bunds. What are these to the average person? A special bun for wiener schnitzel? There's a good special going on at the Der Fun chain in the southwest (http://wienerschnitzel.com). Yet these bunds (for German bonds) are having an impact on the markets this morning. The 10 year auction of the bunds is being proclaimed by the Reuters news as the worst since the creation of the euro. Yes, now even Germany is setting off the alarm bells with funding problems. As Tyler Durden writes, one of our favorite market commentators, “welcome to fiat's greatest hits.” Coming auctions from other places will be interesting in the weeks and months ahead – this includes places like London, Tokyo and eventually here in the good old USofA.

With Thanksgiving looming – so much for the idea of a Turkey Day rally week, though you never know what kind of last minute trick will be pulled out of the sleeve to conjure up some sort of cheer amidst the fear. It almost goes without saying that we will see brisk volume into the midday today, but things should trail off as the Wall Street crowd leaves early for a brief break. And that lower volume could bring additional swing potential into the market today.Friday could be a sleeper of a day, but it will depend on global macro events not going haywire while everyone here in the US ODs on tryptofan, gravy, mashed potatoes, string beans, pie, etc.

Stress Tests

The Big Six U.S. banks are to be stress tested again. What silliness. Remember, these are the banks that OWN the Fed and they are now going to be tested by the Fed? Lol. We all know these banks are walking zombies already with two sets of books that enable them to hide their losses and the true reality of what they are, or really are not any more. Again, you have to look at this stuff and be humored. Oh, wasn't it Dexia that made it through the European stress tests with flying colors? Yes, the Dexia that is on the verge of disintegration and threatening to take the make believe French AAA credit with it. Lol. You can't make this stuff up.

Groupon

This space told you that this would be the outcome. Groupon $GRPN IPO Is Officially a Bust http://stks.co/1FSy. I just see it as a lousy business model.

MF

I am not going to let this MF thing go. I hope to have some sort of material everyday on this travesty. Even for the brazen and crooked Chiago commodities market, the MF collapse is an all time low point in the annals of financial history. Here's a good article from an important denizen of stocktwits.com and an active futures trader and guru, Peter Brandt. Peter was once a guest of my Gold and Silver Radio show (goldandsilverradio.com)....

Commodity Customer Coalition forms to reclaim MF Global funds Chicago-based group says it represents more than 7,000 MF Global customers whose money is temporarily frozen during bankruptcy proceedings See story here. Follow the coalitions web site here. It is a … read more.

Tis the Season - Retail Wet Dreams

I promised to write on the coming holiday retail season and my impressions of winners and losers. No sooner had I published yesterday's blog, I received a note a few hours later from fellow blogger and former fellow broadcaster, Wes Richards, of the must read Wessays (http://wessays.blogspot.com/).

"I have some observations on the retail season ... stores, not their stocks. This is based on being married to a champion bargain magnet who loves to prowl aisles (she can spend 5 hours in a TJMaxx, come out with no purchases and tell you exactly what's there and how it stacks up with the competition,) and because I'm writing a book on same based on my own interest and research.

What hurts Best Buy: diminished customer service. Diminished need for expert floor help as people become more knowledgeable about electronics and shift to Costco and its siblings and to Amazon.com, Tiger.com and Newegg. BBY is not competitive on major appliance prices or selection.

Radio Shack: probably gets a boost from it's recently renewed affiliation with Verizon, especially where their other mobile phone products (ATT, Sprint) have inferior signals. But overall, they're in trouble from the same competitors as BBY and because there's no margin in some of the small stuff they sell.

What hurts mall Jewelers (Kay, Gordons, etc.) overpriced, complex conditions in their warranties. Increased competition from TV shopping channels (primarily the smaller ones, JTV and ShopNbc.)

Macy's: the last traditional mid-line department store chain standing. They have a pricing policy that seems completely unrelated to their costs, which means somethings there have to be overpriced to make up for all the cutting they do in clothing and accessories. They've recently ended their contract with the outfit that leased the better jewelry department and have started running it themselves.

I expect good holiday results from the high-end chains, Nordstrom, Bloomingdales, Saks, Lord & Taylor, Neiman marcus.

What hurts Walmart: bad front ends. Walmart is a store of last resort.

Target: trying to promote itself as low priced non-walmart walmart. People are attracted to logical displays and decent checkout. They're going big into groceries, an iffy, low-margin, high shrinkage area.

Costco benefits from consistently good Consumer Reports ratings on their house brands.

TJMaxx & Marshalls: TJs are better run than marshalls, and both are more upscale than prime compeitor Ross. Smaller space means more $$ per square foot, for what that's worth.

Bed Bath: overpriced, and a bad stop for claustrophobic shoppers. Sloppy front end.

Sears: Eddie Lampert hasn't killed it yet. But wait until there's a rebound in real estate and they and k-mart are gonzo. Lands' End probably will survive because of a huge loyal customer base. But they, too, are hurt by the Eddie connection and by regular free shipping from LLBean."

–

Data Dump Day

Today has been a big data dump day. None of the numbers have cheered Wall Street.

-Initial Jobless Claims 393K vs 390K Estimate. Yawn.

-October Durable Orders -0.7% vs -0.9% consensus; Prior revised to -1.5% from -0.6% . Capital Goods Fell 1.8%, vs. Cons. -1.0%. First, that revision stinks to high heaven and is typical of the faulty data that markets depend on. Secondly, what the heck is going on in the capital goods space? That is one ugly number. I suspect that the economist crowd is way to complacent about the chances for another official recession. Taking it deeper, if there is lacking capital goods investment, there is then little hope these same companies are further investing in human capital buy doing more hiring.

-Oct. Personal Income Up 0.4%, vs. Cons. 0.3%; Spending Up 0.1% . That spending number sure is shabby.

Have a great Thanksgiving.

German bunds. What are these to the average person? A special bun for wiener schnitzel? There's a good special going on at the Der Fun chain in the southwest (http://wienerschnitzel.com). Yet these bunds (for German bonds) are having an impact on the markets this morning. The 10 year auction of the bunds is being proclaimed by the Reuters news as the worst since the creation of the euro. Yes, now even Germany is setting off the alarm bells with funding problems. As Tyler Durden writes, one of our favorite market commentators, “welcome to fiat's greatest hits.” Coming auctions from other places will be interesting in the weeks and months ahead – this includes places like London, Tokyo and eventually here in the good old USofA.

With Thanksgiving looming – so much for the idea of a Turkey Day rally week, though you never know what kind of last minute trick will be pulled out of the sleeve to conjure up some sort of cheer amidst the fear. It almost goes without saying that we will see brisk volume into the midday today, but things should trail off as the Wall Street crowd leaves early for a brief break. And that lower volume could bring additional swing potential into the market today.Friday could be a sleeper of a day, but it will depend on global macro events not going haywire while everyone here in the US ODs on tryptofan, gravy, mashed potatoes, string beans, pie, etc.

Stress Tests

The Big Six U.S. banks are to be stress tested again. What silliness. Remember, these are the banks that OWN the Fed and they are now going to be tested by the Fed? Lol. We all know these banks are walking zombies already with two sets of books that enable them to hide their losses and the true reality of what they are, or really are not any more. Again, you have to look at this stuff and be humored. Oh, wasn't it Dexia that made it through the European stress tests with flying colors? Yes, the Dexia that is on the verge of disintegration and threatening to take the make believe French AAA credit with it. Lol. You can't make this stuff up.

Groupon

This space told you that this would be the outcome. Groupon $GRPN IPO Is Officially a Bust http://stks.co/1FSy. I just see it as a lousy business model.

MF

I am not going to let this MF thing go. I hope to have some sort of material everyday on this travesty. Even for the brazen and crooked Chiago commodities market, the MF collapse is an all time low point in the annals of financial history. Here's a good article from an important denizen of stocktwits.com and an active futures trader and guru, Peter Brandt. Peter was once a guest of my Gold and Silver Radio show (goldandsilverradio.com)....

Commodity Customer Coalition forms to reclaim MF Global funds Chicago-based group says it represents more than 7,000 MF Global customers whose money is temporarily frozen during bankruptcy proceedings See story here. Follow the coalitions web site here. It is a … read more.

Tis the Season - Retail Wet Dreams

I promised to write on the coming holiday retail season and my impressions of winners and losers. No sooner had I published yesterday's blog, I received a note a few hours later from fellow blogger and former fellow broadcaster, Wes Richards, of the must read Wessays (http://wessays.blogspot.com/).

"I have some observations on the retail season ... stores, not their stocks. This is based on being married to a champion bargain magnet who loves to prowl aisles (she can spend 5 hours in a TJMaxx, come out with no purchases and tell you exactly what's there and how it stacks up with the competition,) and because I'm writing a book on same based on my own interest and research.

What hurts Best Buy: diminished customer service. Diminished need for expert floor help as people become more knowledgeable about electronics and shift to Costco and its siblings and to Amazon.com, Tiger.com and Newegg. BBY is not competitive on major appliance prices or selection.

Radio Shack: probably gets a boost from it's recently renewed affiliation with Verizon, especially where their other mobile phone products (ATT, Sprint) have inferior signals. But overall, they're in trouble from the same competitors as BBY and because there's no margin in some of the small stuff they sell.

What hurts mall Jewelers (Kay, Gordons, etc.) overpriced, complex conditions in their warranties. Increased competition from TV shopping channels (primarily the smaller ones, JTV and ShopNbc.)

Macy's: the last traditional mid-line department store chain standing. They have a pricing policy that seems completely unrelated to their costs, which means somethings there have to be overpriced to make up for all the cutting they do in clothing and accessories. They've recently ended their contract with the outfit that leased the better jewelry department and have started running it themselves.

I expect good holiday results from the high-end chains, Nordstrom, Bloomingdales, Saks, Lord & Taylor, Neiman marcus.

What hurts Walmart: bad front ends. Walmart is a store of last resort.

Target: trying to promote itself as low priced non-walmart walmart. People are attracted to logical displays and decent checkout. They're going big into groceries, an iffy, low-margin, high shrinkage area.

Costco benefits from consistently good Consumer Reports ratings on their house brands.

TJMaxx & Marshalls: TJs are better run than marshalls, and both are more upscale than prime compeitor Ross. Smaller space means more $$ per square foot, for what that's worth.

Bed Bath: overpriced, and a bad stop for claustrophobic shoppers. Sloppy front end.

Sears: Eddie Lampert hasn't killed it yet. But wait until there's a rebound in real estate and they and k-mart are gonzo. Lands' End probably will survive because of a huge loyal customer base. But they, too, are hurt by the Eddie connection and by regular free shipping from LLBean."

–

Data Dump Day

Today has been a big data dump day. None of the numbers have cheered Wall Street.

-Initial Jobless Claims 393K vs 390K Estimate. Yawn.

-October Durable Orders -0.7% vs -0.9% consensus; Prior revised to -1.5% from -0.6% . Capital Goods Fell 1.8%, vs. Cons. -1.0%. First, that revision stinks to high heaven and is typical of the faulty data that markets depend on. Secondly, what the heck is going on in the capital goods space? That is one ugly number. I suspect that the economist crowd is way to complacent about the chances for another official recession. Taking it deeper, if there is lacking capital goods investment, there is then little hope these same companies are further investing in human capital buy doing more hiring.

-Oct. Personal Income Up 0.4%, vs. Cons. 0.3%; Spending Up 0.1% . That spending number sure is shabby.

Have a great Thanksgiving.

Tuesday, November 22, 2011

A TV Anchor in Russia GIves A Salute to Obama

Fascinating that this goes on the MSM in Russia.

3rd Quarter GDP Revised lower

The economy of the United States is growing at a revised 3rd quarter annual rate of just 2%. In other words, it is plodding along at a .5% rate on a quarterly basis. This is a nada, nothing, virtually unchanged and this from the official merry, lithium like figures.

Economists had been expecting a 2.5% print. ha! Wrong again.

Personal consumption grew at a 2.3% annual rate. That is certainly nothing to write home about. People had better have oodles of cash saved from their Christmas Club accounts to extract some sort of Q4 miracle. Do I detect a hint of doubt about that notion?

Economists had been expecting a 2.5% print. ha! Wrong again.

Personal consumption grew at a 2.3% annual rate. That is certainly nothing to write home about. People had better have oodles of cash saved from their Christmas Club accounts to extract some sort of Q4 miracle. Do I detect a hint of doubt about that notion?

Market Comment 11/22/11: European Woes; Gold vs Stocks; MF disaster

11/22/11

Follow the bouncing ball – otherwise

known as the stock market. Yes, JP Morgan, as in the original John

Pierpont, was right when he was purported to have said of the the

stock market, “it will fluctuate.” And so the Wall Street Maalox

market plays on. This morning stock futures are saying there's a

diminished chance for a turnaround Tuesday after a Monday that saw

the Dow give back 248 points to 11,547. The S&P 500 landed at

1192. The problem again this morning that has taken futures off the

highs is Europe. Spreads are widening something unbelievable again to

the 200% range and bonds of various EU nations are getting hammered.

When the Dow was down over 300 at the

worst of it yesterday, the 3-month treasury bill was the magnet for

money looking for near term safety. For a time, the the yield on the

3 month dropped to 0.00% and is holding at .01% this morning. That is

not a positive near term sign for stocks as it indicates another

large move out of the stock market to hold something that will pay

nothing in yield, but with the promise of getting the principle back.

What a concept!

As for other flight to quality areas. The dollar got little love as the UUP (PowerShares Dollar Index) finished off the highs, but managed to nudge above the 22 level. In spite of the pronouncements of a strong dollar in the mainstream, the UUP is down from its peak earlier this year of near 23, but did manage to find support just below 21. This narrow and downward trending year long pattern shows a lack of enthusiasm for the greenback even as the euro is on its death bed. Hmmmm, I wonder why? In my best Mr. Rogers voice: Can you say, “fiat” and “massive deficits”? Thought you could!

So there's the on going market irony. The dollar drags along (admittedly bouncing from the March lows), but has largely moped while Treasurys, priced in these dollars, attract money because they are perceived as a safe haven! Yes, the market is an entertaining place.

At one point yesterday, Gold was down

$50/oz. But let's remember, behind a 20% rise in feeder cattle this

year, gold is up 19.2%

in comparison to a 1.3% Dollar decline and a 4.7% S&P 500

drop. On a monthly basis, the stock market indexes (or indices, if

you prefer) are also red, while gold even with yesterday's drop is up

3.5% for the month. In other words, don't be fooled by the daily

moves that we are seeing in gold. The picture remains very green for

the year.

By the way, for the year, the Utilities

stock group has been the best performer, up 9% YTD. The worst

performers – the Financials, down a whopping 23% this year.

Healthcare is the only other positive performer this year with a 2%

gain. Go to finvez.com for further details. I bring this up only to

show, again, the mess the stock market is in vs the double digit gain

for gold this year. It's two different worlds. And there shall come a

time when investors will flock to gold as the real haven (sensibility

shall return), but the entrance will be a small one – like fitting

a camel through the eye of the needle – stealing from a classic New

Testament biblical reference. The time for amassing gold is now and

not at a future point when everyone will attempt to crowd into it.

Unfortunately, $50 moves are going to

happen in gold (we'll likely see even larger moves) to jostle the

unaware and the weak hands. It's the glaring defect of the system

that we're in. Something with core intrinsic historic value is priced

in a sinking value asset – in this case gold being priced in paper

dollars. It's what we must live with for the time being.

Moving on to a few other items of note

The $MF situation looks worse and worse

as we telegraphed at http://www.financialbalerdash.

Analysts are so useful. Canaccord

Genuity resumes Netflix as a Sell. This coming the morning after the

company announced plans for a stock dilutive $400 mln convertible

notes offering to raise $200 mln in cash. The stock is at $69 pre

market. The conversion price is $85. It bought back $200 mln shares

of its stock this year at over $200! Very funny stuff!

Let's talk economy. One of my favorite

economists who I often interviewed at CNBC, Paul Kasriel, of Northern

Trust sees a lost decade coming for the EU. The EU is the world's

largest economy. You've got be asking yourself how this is going to

impact the global economy and the U.S. Economy. http://stks.co/1ELP

. I like Kasriel because he accurate. He is not part of the

'consensus' community of economists who have only declared recession

when we're actually in one. Kasriel is ahead of the curve.

Even more to ponder. From Stocktwits:

RT aliadi US GDP no longer enjoying export advantages of weak $USDX.

PCE starting to top out. wheres growth coming from? #forex.

Good question.

I love Amazon... http://stks.co/1E7Z,

although its stock is certainly vulnerable to market declines.

Speaking of retail. Best Buy and Radio

Shack are not long for this world. BBY is said to be removing

tradition bar codes from products to keep consumers from using their

smartphones to compare prices on their shopping jaunts. BBY is so

losing. Radio Shack is in the same antiquated category. I will have more on

retailers tomorrow from my own channel checks and the impressions

that I get from my teen daughter.

I remember having involvement in

setting up this story when I was at Fox. How Turkeys are processed:

http://www.youtube.com/watch?

Focus Media has been grabbing

headlines. The real pain – the analyst experts on Wall Street who

recommended it. The stock is down 66% since. http://buswk.co/tydweo![]() .

.

$MF Warning

$MF victims: Watch out for scammers who purport to represent the SIPC in emails. The SIPC doesn't do things that way. Don't fall for any scams and lose even more money!!!!!!!

Monday, November 21, 2011

So Gold is Down $50?

Gold down about $50 today. As mentioned, gold gets caught in the cross hairs of the crumbling fiat system because it is priced in dollars. Some see this as an abstract concept, but it is really not since long before there was a dollar there was always this medium of exchange called gold. Gold's intrinsic value has existed for as long as it has been available to use as a means of exchange. Paper? Is just that, paper, with virtually no intrinsic value. Long after the dollar is gone, gold will still be there and will still have real value. Use gold now to translate dollar paper value to the core intrinsic value of gold that will always be there. It's that simple. These daily price swings don't matter since the premise of pricing gold in fiat dollars is faulty to begin with. Dollars and their declining value have only proved the point that gold is a lasting medium of exchange while paper dollars have been steadily sinking. So gold down $50? no big deal unless you're gaming gold to make a quick fiat buck.

$MF Global is One Giant Mess

Outright thievery has occurred. Here are some heads moving on the financial wires:

MF Global Trustee says current plan to distribute 60% of what’s in segregated customer accounts for U.S. futures positions would require ~$1.3b-$1.6b, or nearly all of the $1.6b of assets currently under Trustee control.

• Apparent shortfall may be as much as $1.2b or more, above prior est.; says numbers are preliminary and may change

• Trustee to date has brought ~$3.7b under his control; has distributed ~$1.5b in collateral, is currently distributing $520m cash, leaving ~$1.6b

MF Global Trustee says current plan to distribute 60% of what’s in segregated customer accounts for U.S. futures positions would require ~$1.3b-$1.6b, or nearly all of the $1.6b of assets currently under Trustee control.

• Apparent shortfall may be as much as $1.2b or more, above prior est.; says numbers are preliminary and may change

• Trustee to date has brought ~$3.7b under his control; has distributed ~$1.5b in collateral, is currently distributing $520m cash, leaving ~$1.6b

Fright to Quality

3 month treasury yields are again 0.00% as investors flock to the safety of short term U.S. debt. This is a movie that has played before.

Credit Suisse and the European Outlook

This is ugly folks...

“Extraordinary” things need to

happen by mid-January to prevent progressive closure of all euro

sovereign mkts, runs on even strongest banks, Credit Suisse’s

Jonathan Wilmot says.

• Market pressures may effectively force France, Germany to

strike “momentous deal on fiscal union” much sooner than

currently seems possible, or than either would like: Wilmot

• Only then will ECB will agree to provide necessary bridge

finance: Wilmot

• Italian, Spanish 10-year yields spiking above 9% for short

period “not something one could rule out:” Wilmot

• "Quite possible’’ will see French yields above 5%, bund yields

rise during “critical fiscal union debate:” Wilmot

• U.S. bond yields may fall – or at least not rise – despite

improving growth data through end-year: Wilmot

“Extraordinary” things need to

happen by mid-January to prevent progressive closure of all euro

sovereign mkts, runs on even strongest banks, Credit Suisse’s

Jonathan Wilmot says.

• Market pressures may effectively force France, Germany to

strike “momentous deal on fiscal union” much sooner than

currently seems possible, or than either would like: Wilmot

• Only then will ECB will agree to provide necessary bridge

finance: Wilmot

• Italian, Spanish 10-year yields spiking above 9% for short

period “not something one could rule out:” Wilmot

• "Quite possible’’ will see French yields above 5%, bund yields

rise during “critical fiscal union debate:” Wilmot

• U.S. bond yields may fall – or at least not rise – despite

improving growth data through end-year: Wilmot

The Writing is on the wall. France in trouble

The old joke with the little ones...I see England, I see France, I see your underpants.

An email just arrived:

France Warned on Outlook for AAA Credit Rating By Moody's

2011-11-21 14:38:08.761 GMT

Reuters

Nov. 21 (Telegraph) -- Moody's warned France that a

sustained rise in its debt yields coupled with weakening economic

growth could harm its ratings outlook, fuelling concern the

eurozone's second largest economy might lose its AAA status.

Worries about a high fiscal deficit and banks' exposure to

other troubled European sovereign debt have drawn France into the

firing line of the bloc's crisis, despite the government's

insistence it would do everything necessary to protect its top

rating.

Moody's announced in mid-October it could place France's AAA

rating on negative outlook in three months if the costs for

helping to bailout French banks and other eurozone members

overstretched the country's budget.

Today, the rating agency said that a worsening in the French

bond market - amid fears the sovereign debt crisis was spreading

to the eurozone's core - posed a threat to its credit outlook,

though not at this stage to its actual rating.

"Elevated borrowing costs persisting for an extended period

would amplify the fiscal challenges the French government faces

amid a deteriorating growth outlook, with negative credit

implications," Moody's said.

The premium investors charge on French 10-year debt compared

to the German equivalent was up around 20 basis points at 163 bps

following publication of Moody's report but remained well short

of the 202 bps hit last week, a new euro-era high.

Moody's said that at last week's record level, France pays

nearly twice as much as Germany for long-term funding, adding

that a 100 basis point increase in yields roughly equates to an

additional €3bn (£1.9bn) in yearly funding costs.

Many investors have already discounted a downgrade to

France's AAA rating, given expectations its economy will enter

recession next year.

"In the current environment, people are expecting France to

be downgraded," said Olivier Bizimana of Morgan Stanley, saying

it appeared likely Moody's would revise down France's stable

outlook if nothing changed.

"The fiscal position is probably worse than other triple A

countries and on top of that you don't have the back up of a

central bank."

France's AFT debt agency said on Monday that, despite a

recent increase in the spread of French yields over benchmark

German debt, its average medium- and long-term financing cost

remained close to historically low levels.

An email just arrived:

France Warned on Outlook for AAA Credit Rating By Moody's

2011-11-21 14:38:08.761 GMT

Reuters

Nov. 21 (Telegraph) -- Moody's warned France that a

sustained rise in its debt yields coupled with weakening economic

growth could harm its ratings outlook, fuelling concern the

eurozone's second largest economy might lose its AAA status.

Worries about a high fiscal deficit and banks' exposure to

other troubled European sovereign debt have drawn France into the

firing line of the bloc's crisis, despite the government's

insistence it would do everything necessary to protect its top

rating.

Moody's announced in mid-October it could place France's AAA

rating on negative outlook in three months if the costs for

helping to bailout French banks and other eurozone members

overstretched the country's budget.

Today, the rating agency said that a worsening in the French

bond market - amid fears the sovereign debt crisis was spreading

to the eurozone's core - posed a threat to its credit outlook,

though not at this stage to its actual rating.

"Elevated borrowing costs persisting for an extended period

would amplify the fiscal challenges the French government faces

amid a deteriorating growth outlook, with negative credit

implications," Moody's said.

The premium investors charge on French 10-year debt compared

to the German equivalent was up around 20 basis points at 163 bps

following publication of Moody's report but remained well short

of the 202 bps hit last week, a new euro-era high.

Moody's said that at last week's record level, France pays

nearly twice as much as Germany for long-term funding, adding

that a 100 basis point increase in yields roughly equates to an

additional €3bn (£1.9bn) in yearly funding costs.

Many investors have already discounted a downgrade to

France's AAA rating, given expectations its economy will enter

recession next year.

"In the current environment, people are expecting France to

be downgraded," said Olivier Bizimana of Morgan Stanley, saying

it appeared likely Moody's would revise down France's stable

outlook if nothing changed.

"The fiscal position is probably worse than other triple A

countries and on top of that you don't have the back up of a

central bank."

France's AFT debt agency said on Monday that, despite a

recent increase in the spread of French yields over benchmark

German debt, its average medium- and long-term financing cost

remained close to historically low levels.

The Financial Labyrinth; The Stupid Committee; Bullish on Gold

The Financial Labyrinth

While on our coin adventure in Baltimore, my 7 year old son Nathan and I, went

back to the hotel for a little R&R. What does he decide to watch on

tv? No, not the Cartoon Channel, but a History Channel show about Greek

mythology and the myth about the dreadful and dark Labyrinth on the

Island of Crete. In a strange sort of way Greece and all of the debt

laden countries of Europe today are seemingly trapped in a Labyrinth and

about to be devoured by a debt monster. Some things never change.

The European conundrum drags on. After a few days of being away from the paper markets and seeing brisk activity at the Baltimore coin show, it's back to the reality of watching these fiat markets. As more panic sets in to sell a bunch of euro debt-junk, I picture a long line of cars waiting to go through the tolls. The wait is getting so bad that two cars at a time are trying to go through. Watch for signs of further disorder in the European bond markets in the week ahead. There's only about a Trillion in Italian bonds that need redistributing. Yikes.

I've said in the past that the euro in its present form is a goner. The big guns are now chiming in. The math says it, the setup and other problems make it a certainty that there is no certainty in the euro. When a guy like Warren Buffett comes out of the woodwork and gives a thumbs down, there's trouble as in spike (not a nail) in the euro's coffin. Read here: http://soc.li/QA06NLN

What

moves are left in the Chess game? The king should have died but is

still moving around on the board on "hopes" something can be done.

Every little piece of "hope" news that has come out is akin to the

opponent repeatedly checking the king and the king stepping away to the

net square for brief relief. Seems like it's time to fish

or cut bait as in either European mass unity/disunity/accord/discord to

unite and print new

euro bonds like mad, or call the whole EU thing off due to

irreconcilable differences. IMHO the real key holder is Germany. If they

walk, we're going to see some very negative stock market action. There

is good reason for Germany to walk. It is solvent and its is adverse to

monetizing debt through printing. Yes, they still remember the Weimar

inflation/social disaster that ignited a variety of problems that led to

the rise of you know who in the 1930s. Yes, without Germany, the euro

forces could still go the route of printing and give themselves a little

more time, but printing to add to debt that is already bad debt is not

the way to go.

When and how the euro is taken off life support is the question. Markets in general will be pummeled for a time and it could be that since the markets are discounting mechanism that much of the dump will come ahead of the actual demise of the euro. We could see a circuit breaker type event day for Wall Street. Even our dear friend gold could take a shellacking since the fiat bunch are well trained to sell everything and flock to the dollar.

Printing

euro bonds, we know, would be a temporary stop

gap, but if they can do it they sure will. But Angela has got to be

paying attention to what is happening to her ilk Spain. We are seeing

the

winds of change. The socialists are getting ousted in favor the

conservatives. Spanish Voters Set to Throw Out Socialists in Election.

Germany's Merkel has got to be pay close attention. In the end, she's

out to protect her own neck and though she is pretty much a communist,

she will not risk the wrath of the German people over debt monetization.

Remember, the Germans just recently completed paying reparations for

WWII and also recently experienced a more than $1 bill to unify with

East Germany. The people there, as far as I can tell, are not in the

mood to bailout all sorts of distressed countries. The recent

whispers are not surprising: the Germans are already readying a supply

of paper d-marks in preparation for the demise of the euro as me know

it.

Some of the canaries are still flying

around, meaning not dead yet, but their fate might not be too positive.

Here's an indicator to watch. The TED spread. Wiki has a quick

definition for those who are not familiar: “The TED spread is the

difference between the interest rates on interbank loans and on

short-term U.S. government debt ("T-bills").” It's on the rise again.

Not a positive. The trouble with this indicator is that it can slowly

rise and then boom – it skyrockets. At 50 basis points, the spread is at

its maximum historic norm which usually averages around 30 bps. During

the last crisis, TED ballooned to 200 basis points. Keep at eye on it. http://www.bloomberg.com/apps/

The EIB bond spread (European investment bank bonds) went berserk on

Friday. A Bloomberg terminal grab from Zero Hedge. My goodness... http://www.zerohedge.com/sites

So the financial system is stressed. No rocket science there. The primary push back to the euro's demise comes from banks and insolvent players (the countries) who want to continue to sell their debt no matter what the cost of fresh funny "munee" is. Banks on both sides of the Atlantic face huge liabilities. Its not just the potential for $300 bln in losses directly from bad loans for trans Atlantic banks (read some of our biggest in the U.S, as in the usual suspects), it is also the more than $1+ tril in derivatives that are tied to the bad loans. These numbers are in the realm of bank killer territory. This is a battle of epic proportions and the death of the euro will be a huge reality check for the many. especially in Europe. It will answer that mystery question that most have. How is money valued? (I get that a lot, and from smart people too).

The Stupid Committee

And if all of this wasn't enough to add to the investment gloom, we have our own bunch of monkeys in Washington – The Super Committee, failing to engage in good representative representing. Their task was to forge an agreement to at least show a pretense for fiscal rectitude, although their original goals actually included NO plan for cutting our debt, only to cut the rate in which it grows, which is complete folly to begin with. But I digress. Bottom line, we're back to the threat of another debt downgrade by S&P as the nation will go on some sort of politically concocted fiscal autopilot as we have now crossed the $15 trillion official debt number – which is actually quite a bit higher if you include off budget items, the insanely bloated Fed balance sheet, etc. Just sayin'. This time S&P may be joined by Moody's ad Fitch.

There's little doubt in my mind that we are about to see some interesting fireworks not only in the markets but to societies. Because of its people, its size, resources, etc., the long term outlook for America should be bullish (should be, but we are almost as divided as the nation was in 1860); there may be many pieces to pick up to resume that bullish U.S. Outlook. I'll just briefly mention that our consumerist driven system has a symbiotic relationship with China. Our success with the far east will be more important than ever in the years ahead. Even if the American way of consumption (2/3rds of our GDP), is turned upside down for a time due to system difficulties, China and Asia cannot be ignored in the future. In a post euro and eventually a post dollar hegemony world, everyone will still need to not only get along in the sand box, but will need to be healthy.Economic balance and the madness of giant trade deficits and surpluses must arise from whatever happens in the financial world. That would be a huge positive outcome. However, China and Asia have been shifted to the back burner (at least in financial news coverage although there were some Yuan headlines tis weekend). If Europe finances do collapse and there is an ensuing major economic downturn across the pond, what impact does that have on China and thus the U.S? Yes, we are global in a village sort of way. That's a far more important question that we will explore in future blog posts.

Ultimately, as the fiat paper world is unraveled. gold and other metals will be standouts. Central banks know this, and according to the World gold Council stepped up gold purchases in the last quarter. While it may not become part of regular main street transactions, some form of a monetary gold standard of exchange is going to be necessary to bring a modicum of economic balance back. But there is a catch. If you look back historically to periods of the gold standards of the late 19th century, money supplies could vastly change, banks could fail and economies could suffer (real business cycles as opposed to the perpetual growth models of large corporations and what the Fed has wrongly attempted to do to 'save' the economy). That is to say, a gold standard will only work if society can live within its means. That could be a gut wrenching time of transition for the West and for those who supply many of the goods.Economist Nouriel Roubini was harping over the weekend about the gold standard and bank failures in the 1930s. He is exactly right. Bingo. It was a reduced gold standard by that time, but there was still gold backing. What went wrong, Nouriel? Fractional Reserve Banking. I don't think Nouriel understand this and I will be responding to his tweets later today. As long as there is Fractional Reserve Banking where the bank receives, as an example, $1 from a saver and then lends out $10, the system is geared toward failure no matter what the backing. The future will not be allowing Goldman Sachs to be levered 40 to 1. That stuff must go away. The flip side of this coin, is that the world will eventually come to realize that fiat currencies are just no good. There will be gold backing, BUT other major reforms will also have to be implemented.

In other words, pay no heed to the smoke and fire of the short term. Gold is a keeper for the medium and long term. Whether the system comes to its senses, or we go hyper inflation Mad Max, gold will always be there and will always have value.

CNBC: Buffett Doubts Euro Survival

Folks, this blog has been saying this already, The euro is doomed. The math says it, the setup and other problems make it a certainty that there is no certainty in the euro. When a guy like Buffett comes out of the woodwork and gives a thumbs down, there's trouble as in spike (not a nail) in the euros coffin. Read here: http://soc.li/QA06NLN

Sunday, November 20, 2011

Coin Funds Are Back, Europe, U.S. Super Committee, China Warning

11/20/11

What moves are left in the Chess game? The king should have died long ago but is still moving around on the board. Seems like its time to fish or cut bait as in European mass unity/disunity and unite and print new euro bonds like mad, or call the whole EU thing off due to irreconcilable differences. IMHO the real key holder is Germany. If they walk, we're going to see some very negative stock market action. Markets in general will be pummeled. We could see a circuit breaker type day for Wall Street. Even out dear friend gold could take a shellacking since the fiat bunch are well trained to sell everything and flock to the dollar.

Printing euro bonds, we know, would be a temporary stop gap, but if they can do it they sure will. But Angela has got to be paying attention to what is happened to her ilk Spain. We are seeing the winds of change. The socialists are getting ousted in favor the conservatves. Spanish Voters Set to Throw Out Socialists in Election. Germany's Merkel has got to be pay close attention. In the end, she's out to protect her own neck.

Some of the canaries are flying around, meaning not dead yet, but their fate might not be too positive. Here's an indicator to watch. The TED spread. Wiki has a quick definition for those who are not familiar: “The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills").” It's on the rise again. Not a positive. The trouble with this indicator is that it can slowly rise and then boom – it skyrockets. At 50 basis points, the spread is at its maximum historic norm which usually averages around 30 bps. During the last crisis, TED ballooned to 200 basis points. Keep at eye on it. http://www.bloomberg.com/apps/quote?ticker=.TEDSP:IND.

The EIB bond spread (European investment bank bonds) went berserk on Friday. A Bloomberg terminal grab from Zero Hedge. My goodness... http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2011/10/20111119_EIB_5Y%20EUR%20denom%20bond%20spread%20exploded.png

As if all of this wasn't enough to add to the investment gloom, we have our own bunch of monkeys in Washington – The Super Committee, failing to engage in good representative representing. Their task was to forge an agreement to at least show a pretense for fiscal rectitude, although their original goals actually include NO plan for cutting our debt, only to cut the rate in which is grows, which is complete folly to begin with. But I digress. Bottom line, we're back to the threat of another debt downgrade by S&P as the nation will go on some sort of politically concocted fiscal autopilot as we have now crossed the $15 trillion official debt number – which is actually quite a bit higher if you include off budget items, the insanely bloated Fed balance sheet, etc. Just sayin'.

Oh, the stresses are all over: Can Europe's Crisis Force US Funds to Break the Buck?

There's little doubt in my mind that we are about to see some interesting fireworks not only in the markets but to societies. Because of its people, it's size, resources, etc., the long term outlook for America should be bullish (should be, but we are almost as divided as the nation was in 1860). But there may be many pieces to pick up to resume that bullish U.S. Outlook. Perhaps things are getting overblown concerning the woes of Europe and its impact on the U.S (though there are many debatable points, and we certainly have big problems here to tackle), but China and Asia have been shifted to the back burner. If Europe finances do collapse and there is an ensuing major economic downturn across the pond, what impact does that have on China and thus the U.S? Yes, we are global in a village sort of way. That's a far more important question that we will explore in future blog posts.

I was at the Whitman Coin Show in Baltimore Thursday through Saturday. It was excellent show made all the more exciting as I witnessed the launching of Certified Assets Management International. Company co-founder and co president, Robert Higgins, and his team are a force to be reckoned with in the coin and bullion business. For people like me of modest means, this stuff is eye candy, yet for others the trading of high ticket, museum quality rarities occurs on a regular basis on the bourse floor: Photo of the Day – Keep the change… for $300K. Also very exciting is the launching of five new coin funds that offer investors a viable alternative to the weak performance of the benchmark S&P 500. Details are here: http://www.certifiedassets.com/inv/the-funds/coin-funds-overview/. Yes, finally alternatives to $GLD, $SLV, etc.

The Financial Labyrinth

While on our coin adventure in Baltimore, my son Nathan and I, went back to the hotel for a little R&R. What does he decide to watch on tv? No, not the Cartoon Channel, but a History Channel show about Greek mythology and the myth about the dreadful and dark Labyrinth on the Island of Crete. In a strange sort of way Greece and all of the debt laden countries of Europe today are seemingly trapped in a Labyrinth and about to be devoured by a debt monster. Some things never change.

The European conundrum drags on. After a few days of being away from the paper markets and seeing brisk activity at the Baltimore coin show, it's back to the reality of watching these fiat markets. As more panic sets in to sell a bunch of euro debt-junk, I picture a long line of cars waiting to go through the tolls. The wait is getting so bad that two cars at a time are trying to go through. Watch for signs of further disorder in the European bond markets in the week ahead. There's only about a Trillion in Italian bonds that need redistributing. Yikes.What moves are left in the Chess game? The king should have died long ago but is still moving around on the board. Seems like its time to fish or cut bait as in European mass unity/disunity and unite and print new euro bonds like mad, or call the whole EU thing off due to irreconcilable differences. IMHO the real key holder is Germany. If they walk, we're going to see some very negative stock market action. Markets in general will be pummeled. We could see a circuit breaker type day for Wall Street. Even out dear friend gold could take a shellacking since the fiat bunch are well trained to sell everything and flock to the dollar.

Printing euro bonds, we know, would be a temporary stop gap, but if they can do it they sure will. But Angela has got to be paying attention to what is happened to her ilk Spain. We are seeing the winds of change. The socialists are getting ousted in favor the conservatves. Spanish Voters Set to Throw Out Socialists in Election. Germany's Merkel has got to be pay close attention. In the end, she's out to protect her own neck.

Some of the canaries are flying around, meaning not dead yet, but their fate might not be too positive. Here's an indicator to watch. The TED spread. Wiki has a quick definition for those who are not familiar: “The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills").” It's on the rise again. Not a positive. The trouble with this indicator is that it can slowly rise and then boom – it skyrockets. At 50 basis points, the spread is at its maximum historic norm which usually averages around 30 bps. During the last crisis, TED ballooned to 200 basis points. Keep at eye on it. http://www.bloomberg.com/apps/quote?ticker=.TEDSP:IND.

The EIB bond spread (European investment bank bonds) went berserk on Friday. A Bloomberg terminal grab from Zero Hedge. My goodness... http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2011/10/20111119_EIB_5Y%20EUR%20denom%20bond%20spread%20exploded.png

As if all of this wasn't enough to add to the investment gloom, we have our own bunch of monkeys in Washington – The Super Committee, failing to engage in good representative representing. Their task was to forge an agreement to at least show a pretense for fiscal rectitude, although their original goals actually include NO plan for cutting our debt, only to cut the rate in which is grows, which is complete folly to begin with. But I digress. Bottom line, we're back to the threat of another debt downgrade by S&P as the nation will go on some sort of politically concocted fiscal autopilot as we have now crossed the $15 trillion official debt number – which is actually quite a bit higher if you include off budget items, the insanely bloated Fed balance sheet, etc. Just sayin'.

Oh, the stresses are all over: Can Europe's Crisis Force US Funds to Break the Buck?

There's little doubt in my mind that we are about to see some interesting fireworks not only in the markets but to societies. Because of its people, it's size, resources, etc., the long term outlook for America should be bullish (should be, but we are almost as divided as the nation was in 1860). But there may be many pieces to pick up to resume that bullish U.S. Outlook. Perhaps things are getting overblown concerning the woes of Europe and its impact on the U.S (though there are many debatable points, and we certainly have big problems here to tackle), but China and Asia have been shifted to the back burner. If Europe finances do collapse and there is an ensuing major economic downturn across the pond, what impact does that have on China and thus the U.S? Yes, we are global in a village sort of way. That's a far more important question that we will explore in future blog posts.

Thursday, November 17, 2011

European Mess, Celente Gets Burned. Gold, Jobs Trade $$

I am heading for Baltimore for a little end of week coin confab. A few things (and I mean a few. Lol) are on my mind.

- Europe. Europe's €1 trillion (£854bn) rescue fund has been forced to buy its own debt as outside investors become increasingly concerned about the worsening eurozone sovereign debt crisis.

[link to www.telegraph.co.uk]. The only answer to this debt conundrum is print, print, print. And they shall. French and Spanish bond auctions were weak meaning higher yields, or more dead canaries in the coal mine. - Gold. Down, despite this certainty of mad printing, down again today. It remains subject to the whims of fund managers and the like who need to lighten up when their paper “investments” go up in flames, or are about fall off a cliff. Yet, there are buyers who support the gold market. Take Central Bankers, please. Apologies to the great Henny Youngman. But in all seriousness, central banks are buyers: CNBC: http://www.cnbc.com/id/

45335415. - This again says to me, be patient with gold even if the price is volatile since it is priced in volatile dollars. It's at a bargain price. Physical gold, especially rare coins. Did you hear about futurist and doom and gloomer Gerald Celente having his hind quarters handed to him at Mann (MF) via the CME and Lind Woldock? http://www.youtube.com/watch?

v=W02n-wjPqNE Please pardon the giggly anchor. The video is not really funny.

- Jobless claims at 388k (lower). Color me a skeptic. Millions are off the government's jobless benefits and no longer eligible for benefits. It will be interesting when the job leavers and those who have run out of benefits start being tabulated again as part of a group of renewed job seekers.. The UNemployment rate will actually rise thanks to the screwy way the data is thrown together. Is this the excuse for Wall Street to rally today? Or is the prize behind door #4....

- Housing starts were stronger than expected. The smoke and mirrors used here center around strong multi family unit construction. Single family starts? Dead. The crowd could choose the 'reality' door and well that would result in what we saw yesterday: a little withdrawal of the "hopes".

- Gee Wally, how does this happen? From Zerohedge.com: “The export miracle, that we have been cantankerously remonstrating against the possibility of for much of the last year, appears to be running into a wall of reality. The Economist

puts its usual number-centric and acerbic spin on the nonsense that economists spew with regard to everyone exporting their way out of the debt-laden deleveraging quagmire we are in. Economists are constantly urging governments to adopt policies that would reduce global imbalances—which, in crude terms, means that China should slash its current-account surplus and America its deficit. Yet they ignore the biggest imbalance of all: the current-account surplus that planet Earth appears to run with extraterrestrials. The world exported $331 billion more than it imported in 2010!”

jk here: I'll tell you how. From trade formulas created in the 30s. Shhhh. It's a deep and dark little secret. Yes, the Fed has it backwards. Perhaps we need LESS consumption? Wouldn't that be a shocker.

Tuesday, November 15, 2011

11/15 Market Comment: Just Another Day of Eurp Angst

11/15/11

I hear the Wall Street pom pom boys say it often. “Stocks are cheap”. And they sight something like forward p/e ratios and pass themselves off has Whiz Kids. Perhaps stocks are not as cheap as one might believe. This is definitely worth a look. I've never seen this chart. It's very clever: CHART OF THE DAY: One Huge Reason The Stock Market Isn't Cheap...

From the early futures indications, it appears stocks will become a bit more cheaper, at least at the open. FWIW from a CNBC interview: Blackrock's Fink: "more cautious" on stocks than he was 2 mos ago. "We have a lotta event risk in the next few wks." No kidding, Sherlock. Lol. Euro troubles continue to weigh on sentiment.

If I am going to be wrong about the euro's eventual demise it will be because it happens quicker than expected. The contagion is spreading. The credit markets know the score before the equity markets. Here's a Bloomberg screen shot. Ugly-ugly-ugly French CDS chart: http://ow.ly/1ApiWE

Italian 10 year yields are back above 7%.

Even in Belgium 10 yr yields are approaching 5%. This is the new things are lookig up, but in the wrong sort of way.

Gold is up about $5. The Zero Hedge blog reports that billionaire investor John Paulson is moving from GLD paper to bullion.

There is also this ditty that's very much gold related: http://www.businessweek.com/

Officially massaged and understated inflation data shows a roughly 6% pace of PPI inflation. In the real world, it's clear we're looking at inflation a few points above the gubbamint numbers, at least according to such luminaries as John Williams and his Shadow Government Stats web site. Oct. PPI: -0.3%, vs. Cons. -0.1%, Up 5.9% YoY; Core PPI Unchanged.

We will shop until we literally drop. There are plans being hatched by the nation's largest retailers to open Thanksgiving evening. Yes, they can't wait for the Friday free for all known as Black Friday. I can just imagine what will be going on at stores Thanksgiving night. “Ooooh, I can buy a 4th iPod for myself! . Data today: Oct. Retail Sales: +0.5%, vs. Cons. +0.3% .

If you believe in the rule of law, this ought to get your hackles up: http://www.zerohedge.com/

If you missed it last night, here's the icky, uncomfortable interview Bob Costas did with Jerry Sandusky: http://read.bi/uuvD4c. Any of my male readers horse around with other males but don't touch inappropriately?

Any good news? Wal Mart reports first sales rise in 9 quarters. Gosh, that's more than 2 years. But I take that back. It still missed EPS estimates.

Monday, November 14, 2011

11/14/11 Italy and rearranging deck chairs

11/14/11

One of the cooler things that my Grandmother gave me a few years before she passed away at the age of 97 in 1997 was a book about the sinking of the Titanic. It was published shortly after the ship went down. It's an old hard covered book that is still in decent shape (and no I am not going to be auctioning it off.)

In the later movies, we all remember the poignant scene where the band on deck strikes up Nearer My God to Thee as the ship is about to do it's backwards swan dive. Let's think of the euro instead as the ship that even God could not sink (an unwise statement someone made before the Titanic left for its incompleted trip to NY). The supposed unsinkable euro has been mortally wounded by an iceberg that includes such problems as overly burdensome sovereign debt loads (eg. 120% debt to GDP ratio for Italia); under capitalized banks; unsustainable cradle to grave social programs; derivatives; a wide chasm of the haves (Germany) and the have nots (Greece, Italy, etc) screwed up trade imbalances, etc.

When you really think about this, pan European rates were fairly uniform. That was a major flaw. It's one thing for Germany to be operating at a low interest rate environment, but quite another for the shaky countries to be enjoying the same low rates. Those shaky countries rode the wave of low rates to consume ever more (eg products from Germany) instead of repairing structural problems while at the same time creating glaring current account deficit problems. So now as rates have normalized (eg another Italian auction featuring all time euro high rates for Italy) it is easy to understand why there is such a shock to the system and why the euro is on borrowed time. Now austerity is mandated for the hobbled (a further shock). The party is over. As some said somewhere, the carpet smells like beer, the fridge is busted, the toilet is clogged and there's puke on the driveway (some party).

It is not just the dollars and cents of debt, but also the reality that weaker countries like Italy, or Greece, can't operate on the same playing field as Germany, France (which has a lot of questions surrounding it). The formation of the EU, as it becomes more apparent every day as we attempt to do some on the fly forensics, was flawed from the get go by allowing sovereign nations to operate as sovereigns with their own governments and idiosyncrasies while being unified under a common currency. It's back to the old drawing board. It would be as if our 50 states were autonomous and had only the dollar in common.

As for the Goldman bred Mario Monti taking the reigns in Italy? Ha. Think neatly rearranging the deck chairs on the Titanic before she goes down. This is beyond even the cunning skills of a person who is directly connected to the banking cabal that calls the shots and is desperately trying to buy more time.

Don't believe my skepticism? Here's some armchair commentary from strategists at a big European bank.

“Advance praise for Monti’s

technocratic government could be wiped out by economic/market

realities Italy faces in coming months, Commerzbank strategists

Marcel Bross and Christoph Reiger write in client note.

• Maintain underweight recommendation on EU peripherals, suggest investors use “potential Monti-relief” towards 6.22-6.50% in 10-yr on-the-run BTP to further reduce exposure

• Recession looms for Italy: while planned reforms are important steps, they come too late; experience from other peripherals shows “crippling impact of austerity on faltering economies

• Recent price action will make it more difficult to find buyers: those who hoped for ‘‘implicit ECB cap’’ and bought BTPS at 5%-6% have found there is none

• ‘‘Instead, the vicious circle of thinner liquidity and higher volatility catapulted yields to somewhere between 7% and 8% where liquidity disappeared completely before aggressive ECB buying (and Monti hopes) turned the tide, for now”

• It is hard to imagine those same investors will buy again at artificially low yields of ~6%-6.5% given concern yields could soar even higher next time

• Expect banks to continue unloading peripheral holdings

• Supply will need to increase to EU30b-EU35b/month in bills and bonds

• Estimates ECB has already bought more than double the supply of BTPs and CCTs-eu since the start of SMP2 -- “evidently not enough to keep yields anchored at sustainable levels”

• Upcoming SMP data should confirm aggressive buying

• “Given the ‘temporary and limited’ mandate of the SMP and with the Bundesbank opposing the ECB as lender of last resort, we see an increased risk that BTP yields will rise again”

• Large-scale ECB buying program would be most effective crisis response; however, “appears unlikely any time soon”

• Using IMF to monetize peripheral debt would counter numerous technical, legal and political hurdles

• The most likely scenario ahead is the one that is the “worst for the market”: continued piecemeal approach from EU leaders, “hoping that the questionable EFSF revamp will do the trick”

technocratic government could be wiped out by economic/market

realities Italy faces in coming months, Commerzbank strategists

Marcel Bross and Christoph Reiger write in client note.

• Maintain underweight recommendation on EU peripherals, suggest investors use “potential Monti-relief” towards 6.22-6.50% in 10-yr on-the-run BTP to further reduce exposure

• Recession looms for Italy: while planned reforms are important steps, they come too late; experience from other peripherals shows “crippling impact of austerity on faltering economies

• Recent price action will make it more difficult to find buyers: those who hoped for ‘‘implicit ECB cap’’ and bought BTPS at 5%-6% have found there is none

• ‘‘Instead, the vicious circle of thinner liquidity and higher volatility catapulted yields to somewhere between 7% and 8% where liquidity disappeared completely before aggressive ECB buying (and Monti hopes) turned the tide, for now”

• It is hard to imagine those same investors will buy again at artificially low yields of ~6%-6.5% given concern yields could soar even higher next time

• Expect banks to continue unloading peripheral holdings

• Supply will need to increase to EU30b-EU35b/month in bills and bonds