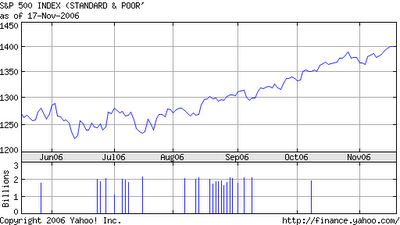

Merger mania whether across transatlantic time zones with the Nasdaq bid, or in the merger-hot mining sector, or by way of the ongoing LBO's (more than $3 trillion worth this year) can only serve to support the stock market even as ominious housing meltdown storm clouds develop on the horizon. This chart of the S&P 500 illustrates a bullish upward channel - the 'trend remains your friend' - for now.

Futures are on the soft side this morning, following a modestly positive Friday expiration. Put to call ratios remain low (though 2 mln Wynn calls that traded Friday on a dividend capture play have distorted the picture) and the VIX continues to flirt with all time lows. That low VIX isn't necessarily a good thing since it indicates dangerously low complacency that will eventually be resolved in probably a not so happy way for the bulls. PD in pre market trading is up $27 at $121, while FCX is down only $4. EOP is up by better than $3

Futures are on the soft side this morning, following a modestly positive Friday expiration. Put to call ratios remain low (though 2 mln Wynn calls that traded Friday on a dividend capture play have distorted the picture) and the VIX continues to flirt with all time lows. That low VIX isn't necessarily a good thing since it indicates dangerously low complacency that will eventually be resolved in probably a not so happy way for the bulls. PD in pre market trading is up $27 at $121, while FCX is down only $4. EOP is up by better than $3

.

My holding in X calls may benefit from another $2+ early rally in shares of U.S. Steel on steel industry merger speculation which is turning white hot. The catalyst for further upside in shares of steel today is the $2 bln takeover of Oregon Steel Mills by Russia's Evraz Group. Who's next? X, NUE, CHAP, STLD??

WTI is modestly lower, and this is where I will continue to focus the bulk of my trading activity this holiday shortened week. The large specs are now bullish for the first time since October, but even with the implied bullishness the December contract still went off the board at its lowest since the summer of 2005.

Gold is up about $2, but I continue to stay away until I see a further breakdown in the dollar and I become bullish on crude.

No comments:

Post a Comment