In the ever merger-hot mining industry, Phelps Dodge (PD) is Freeport-McMoRan's (FCX) to have and to hold for the price of $25.9 bln in cash and stock. Phelps is being taken out at $126/shr vs its Friday closing price of $95. Trading in PD call options was moderate at about 9,000 contracts for the December strikes.

In another whopper of a deal, The Wall Street Journal reports Blackstone is set to annonce a takeover of Equity Office Properties (EOP) for $20 bln, or $48.50/sh. That's about a 10% premium to Friday's closing price. Call options trading in EOP was fairly quiet on Friday, with only about 600 December calls trading - 522 were the December 45s.

The ongoing activity of competitors gobbling each other up and private equity firms willing to pay decent premiums to take companies private continues to be a large factor in the 'bullish column' for investors to be mindful of.

It's only 7 p.m. eastern time, but crude oil is off to a lower start with the Jan contract down a-half percent, or 29-cents/bbl. Natural Gas is down .8%. In the near term, there's more reason to be bearish than bullish - the chief factors being plentiful supply both in all strata of the barrel market and in underground natural gas storage; mild northeast temps relative to norms; and no immediate prospect of mushroom clouds being seen over the Middle East. So my bias and approach toward trading crude oil futures will be a continued bearish mindset, but being ever mindful of emergent, or nascent bullish factors like geopolitical events and a swing toward a colder direction for the winter season (at some point). Thus far, temps are looking great if you like it on the milder side. The operational GFS is predicting high temps in NYC to remain above 40f through December 3rd! This will continue to be a bearish influence on the energy markets. But here's something else to consider:

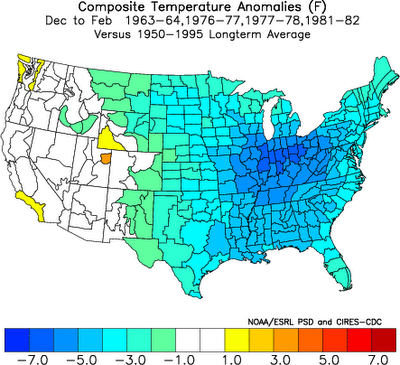

The above is a composite of how aggregate winters turned out following fall seasons with a mild/moderate El Nino: cold winters. This stuff isn't perfect, of course, but it's a reminder backed by past data that a surprise turn of events may occur to catch those off guard who are expecting another above average winter and the bearish impact on the energy markets to continue through the winter.

No comments:

Post a Comment