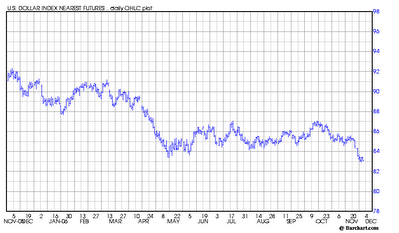

83 not only on this short term chart, but on multi year charts is a major support area. Traders are determined to see how low they can push the buck. This morning sterling is at a 14 yr high and the dollar is not to far against its recent low against the Euro. The dollar weakness has perked up gold futures again, with the metal flying past the $640 resistance this morning. We're back in with the January contract.

There's another barrage of economic data - every things from October core PCE, PCE deflator, personal spending, personal income and November Chicago PMI.

Stock futures are drifting higher on follow through to yesterday's momentum, but the effect of the weakening dollar and rising crude oil prices could put a damper on things as the day progresses.

Natural gas got to has high as $9.05 overnight, but has since pulled back by 14-cents - enough to stop us out. We use protective stops not only to protect against loss, but also to protect profits, and they've been big profits over the last week in the energy market for us. We may jump back in after the EIA data is released - expected to show a 24 bcf withdrawal. There is less technical resistance for crude and crude is now closing in on the $63/bbl level.

No comments:

Post a Comment