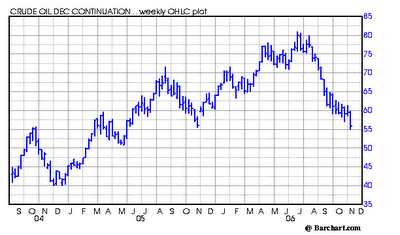

For the past week, the December WTI contract, which expired today, slid 6%.

Interestingly enough, the January contract finished the day higher by 40 cents to $58.97 a barrel, for about a $3 premium to December. The overall contango has remained remarkably wide across the barrel market, and a $3 premium for January delivery indicates the expectation, at least as of today, that OPEC may be able to get its act together and reduce production and that colder weather might actually set in by January. The EIA numbers that caught my eye earlier in the week were imports running below 10 MMbbl/d for two consecutive weeks, providing at least scant anecdotal evidence that the OPECers are trying to reduce output.

IF seasonably cold temps emerge by the end of December and a real effort by OPEC to slice output materializes that would certainly enable WTI to make a run back into the low 60's. But the jury is still out and with the technical damage seen in the December contract this past week, this time frame with the OPEC and weather questions still up in the air, may be the best chance yet the bears have to pierce $55 and make a run for $50.

Incidentally, the latest Commitments of Traders report shows a fairly even keel of short Commercials vs longs with 742,030 long and 741,315 short. Non commercial shorts dropped by over 28,000 contracts to 147,904 vs 165,257.

In the week ahead, While my bias remains fairly bearish on crude, I am going to continue to go with the flow via eMini contracts either by selling them short, or as I did today, taking a long position off the intraday low. I will continue to open and close out futures positions in both crude and natural gas on a day to day basis. With the Jan contract at $58, I am ready for trading parameters similar to the recent action in the December contract: $55 area to the downside; $62 to $63 to the upside, at least until fundamentals like OPEC and the weather become clearer.

No comments:

Post a Comment