While there may be plenty of momentum left to enable JCP to break historic resistance and make a run for the $100 mark, for me, every $1 made above that resistance would have been a dollar made with worry attached to it which is just not worth it.

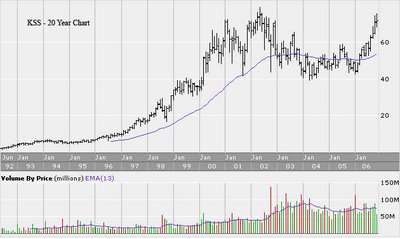

The 20 year chart for KSS shows the same problem of bumping up against major, multi-year resistance:

KSS, by the way, was one of the few retail laggards on Wednesday, falling by more than 1%. Money also rotated out of ANN, CBK, CWTR (big earnings miss), CHS and BDOG. Sears Holdings (SHLD) was the biggest winner Wednesday with a gain of almost 3%. I will have more on SHLD in a separate post.

The chart of Nordstrom shows a similar pattern of amazing returns and begs the question of, “why jump into these names now??”:

I have no doubt that with services like TheStreet.com touting these stocks, the crowd will jump in, but I’m not comfortable following the lemmings… err, the crowd. Sure, names like JCP, JWN, KSS could be seen as positive-trend-is-your-friend plays, and that there’s always the chance that the season will surprise to the upside (consumers are a clever bunch when it comes to finding extra spending money); but I’m going to keep the powder dry where the major retailers are concerned. I will revisit this stance when I see the same store sales data for November next week.

There is no doubt about the momentum surrounding some of the names in the space, and from an options standpoint, we're going to jump in for short term plays (as we do, I will publish the plays on the blog).

No comments:

Post a Comment