Just for fun, we picked up the Dec30 Puts in Cheesecake Factory (CAKE) at just before the close. I went short on the premise that "upscale casual dining" will only continue to suffer as the economy slows. JP Morgan also named CAKE its top short pick on Wednesday. It looks like the short play will pay off handsomely tomorrow. While CAKE management didn't have the you-know-whats to come clean during the conference call, the company issued a warning via press release that it would miss 4th quarter earnings and revenue estimates in the dark of night - at 9 p.m. eastern time! Can you believe that?? Given the fact that the company opted for subterfuge instead of warning four hours earlier during the conference call when after hours trading was taking place, we anticipate a wrathful reaction Friday morning.

Just for fun, we picked up the Dec30 Puts in Cheesecake Factory (CAKE) at just before the close. I went short on the premise that "upscale casual dining" will only continue to suffer as the economy slows. JP Morgan also named CAKE its top short pick on Wednesday. It looks like the short play will pay off handsomely tomorrow. While CAKE management didn't have the you-know-whats to come clean during the conference call, the company issued a warning via press release that it would miss 4th quarter earnings and revenue estimates in the dark of night - at 9 p.m. eastern time! Can you believe that?? Given the fact that the company opted for subterfuge instead of warning four hours earlier during the conference call when after hours trading was taking place, we anticipate a wrathful reaction Friday morning.

Thursday, November 30, 2006

CAKE - Cheesecake Factory

Just for fun, we picked up the Dec30 Puts in Cheesecake Factory (CAKE) at just before the close. I went short on the premise that "upscale casual dining" will only continue to suffer as the economy slows. JP Morgan also named CAKE its top short pick on Wednesday. It looks like the short play will pay off handsomely tomorrow. While CAKE management didn't have the you-know-whats to come clean during the conference call, the company issued a warning via press release that it would miss 4th quarter earnings and revenue estimates in the dark of night - at 9 p.m. eastern time! Can you believe that?? Given the fact that the company opted for subterfuge instead of warning four hours earlier during the conference call when after hours trading was taking place, we anticipate a wrathful reaction Friday morning.

Just for fun, we picked up the Dec30 Puts in Cheesecake Factory (CAKE) at just before the close. I went short on the premise that "upscale casual dining" will only continue to suffer as the economy slows. JP Morgan also named CAKE its top short pick on Wednesday. It looks like the short play will pay off handsomely tomorrow. While CAKE management didn't have the you-know-whats to come clean during the conference call, the company issued a warning via press release that it would miss 4th quarter earnings and revenue estimates in the dark of night - at 9 p.m. eastern time! Can you believe that?? Given the fact that the company opted for subterfuge instead of warning four hours earlier during the conference call when after hours trading was taking place, we anticipate a wrathful reaction Friday morning.

LBO Chatter

Gold

Chicago PMI

Wow... down to 49.9. This is a diffusion index, meaning any reading under 50 indicates CONTRACTION. Economists thought the index would rise to 54.5. Doh! This is certainly a negative surprise for the stock market and selling is already coming in. Plus, the weak PMI is on top of another weak jobless claims report - this time the filings went up 34,000. The March Euro contract is now closing in on 1.3300 as the dollar weakens on this data and gold is trading at its high of the day with the January contract already testing $650/oz. But don't worry - Helicopter Ben Bernanke told us the other day that the economy is just fine!

Wow... down to 49.9. This is a diffusion index, meaning any reading under 50 indicates CONTRACTION. Economists thought the index would rise to 54.5. Doh! This is certainly a negative surprise for the stock market and selling is already coming in. Plus, the weak PMI is on top of another weak jobless claims report - this time the filings went up 34,000. The March Euro contract is now closing in on 1.3300 as the dollar weakens on this data and gold is trading at its high of the day with the January contract already testing $650/oz. But don't worry - Helicopter Ben Bernanke told us the other day that the economy is just fine!11/30/2006 Morning Market Comment

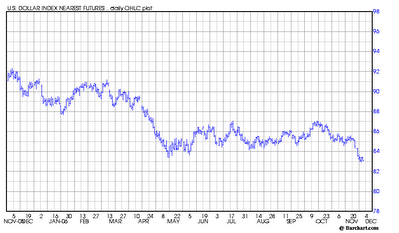

83 not only on this short term chart, but on multi year charts is a major support area. Traders are determined to see how low they can push the buck. This morning sterling is at a 14 yr high and the dollar is not to far against its recent low against the Euro. The dollar weakness has perked up gold futures again, with the metal flying past the $640 resistance this morning. We're back in with the January contract.

There's another barrage of economic data - every things from October core PCE, PCE deflator, personal spending, personal income and November Chicago PMI.

Stock futures are drifting higher on follow through to yesterday's momentum, but the effect of the weakening dollar and rising crude oil prices could put a damper on things as the day progresses.

Natural gas got to has high as $9.05 overnight, but has since pulled back by 14-cents - enough to stop us out. We use protective stops not only to protect against loss, but also to protect profits, and they've been big profits over the last week in the energy market for us. We may jump back in after the EIA data is released - expected to show a 24 bcf withdrawal. There is less technical resistance for crude and crude is now closing in on the $63/bbl level.

Wednesday, November 29, 2006

Pickens Sees Slim Pickins'

Boone Pickens is not one to pull punches. In this article,the famed Texas oilman warns of a coming supply problem. Yes, he's in the peak oil doom and gloom camp, but when a guy like this, who knows the oil industry inside and out, warns that the world will run out of oil in only 40 years - it pays to pay attention.

Boone Pickens is not one to pull punches. In this article,the famed Texas oilman warns of a coming supply problem. Yes, he's in the peak oil doom and gloom camp, but when a guy like this, who knows the oil industry inside and out, warns that the world will run out of oil in only 40 years - it pays to pay attention. HD - Home Depot - Is It a Takeover Candidate?? LOL

Street Noise: CNBC reported earlier today that private equity may be eyeing home improvement retailing behemoth Home Depot. That seems doubtful, at least if you look at the options. Take the December 37-1/2 calls. The offer has been trading about 10-cents BELOW theoretical value. This again highlights the danger of chasing after takeover rumors. More than 7000 of the HD Dec37-1/2 calls traded today as speculators went a chasin'. Oh, well... it's only money - right?

Street Noise: CNBC reported earlier today that private equity may be eyeing home improvement retailing behemoth Home Depot. That seems doubtful, at least if you look at the options. Take the December 37-1/2 calls. The offer has been trading about 10-cents BELOW theoretical value. This again highlights the danger of chasing after takeover rumors. More than 7000 of the HD Dec37-1/2 calls traded today as speculators went a chasin'. Oh, well... it's only money - right?

Midday Market Comment

While stocks are off the best levels, this is a seasonally positive time for the market, volatility is slipping again, and so it is likely that the uptrend will continue at least through the month of December, before we get another batch of earnings reports in January. Especially close attention will need to be paid to the dollar, or really the Euro. A further sharp Euro advance could mean further stock market disruptions similar to the declines on Friday and Monday. For now, March Euro futures are down a quarter-percent with $1.3200 showing solid support. The dollar selling breather today is keeping the gold bulls on the defensive with the metal down $2/oz.

Natural Gas

DG - Dollar General

A Further Leg Up in the Energy Complex

F - Ford

RHAT - Redhat

11/29/2006 Morning Market Comment

There are going to be plenty of catalysts to enhance moves either way in various markets. Economic data will begin to flow with the 8:30 ET release of GDP, predicted to be revised to a 1.8% annual pace in Q3. The PCE inflation gauge is expected to remain steady at 2.3% and will be closely watched after yesterday's whine by the Fed chief that inflation remains uncomfortably high. Did anyone get the feeling that helicopter-Ben with his forecast for continued GDP growth next year is not connected with reality? At 10, October new home sales data will be released and a slight decline to 1,050k annual rate is expected. The Beige Book will be out midday.

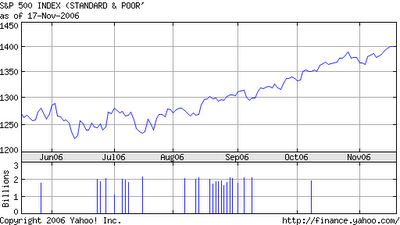

We continue to find it hard to be overly bearish about the stock market at this point, and indicators like a decline in the put to call ratio and volatility index yesterday keep us in the mildy bullish camp. No doubt, the dollar slide, if it continues, will pose major risk to stock holdings; but the stock market is not showing signs - as of this time - of rolling over. We would not consider initiating a bearish play on the broader market until or unless the cash S&P 500 breaks below 1375; the SPY puts might be in order. All that we've seen out of the selling of Friday and Monday is a testing of the lower range of the recent upward channel in the cash S&P 500 which closed yesterday at 1386.

Energy continues to attract a bid, with WTI climbing to $61.50 overnight, but now back at the 61.15 mark. With colder than normal temps forecast for the first 10 days of December in the northeast and talk of another OPEC production cut, we will continue to hold our long position in crude futures to see if WTI can close above the Rita/Katrina trend line of $61.49.

Gold - We're staying away until the metal can close above $641.

Euro - We're on the sidelines until the Euro looks a bit less overbought.

Tuesday, November 28, 2006

The Currency 'Nuclear Option'

Gold

We're also going to initiate a position in Euro futures. I will post more on that separately.

Chico's Puts

Earnings matched at 24c, but revs were light at $404 mln vs estimates of 417. November same store sales fell .4%. Shares have managed to nudge higher on relief the results weren't even worse than they were.

CHS - Chico's Earnings

Wind River Systems (WIND)

GOOG - Google in the News

Today's Eco Data - Round #1

Total Orders fell -8.3% (yikes), were down 1.7% ex transports and down 6.4% ex defense. So take the war machine out and you've got numbers that are a bit bearish for stocks though reaction to the data has only been modest thus far. The bulls can only hope there's an upward surprise in existing home sales numbers at 10.

11/28/06 Morning Market Comment

Investors are waiting for 8:30 ET Durable Goods and 10 a.m. existing home sales numbers and consumer confidence. 12:30 Helicopter-Ben will be speaking about the economic outlook and we'll hear from Chicago Fed President Moskow a little more than 4 hours later. Thus far, when Fed officials have spoken in recent weeks in tones to soothe dollar worries, they've gotten no respect from the markets.

Palm (PALM) cut its earnings forecast and pushed back the introductiuon of its TREO 750; PALM Is down 5%. Nokia (NOK) facing big network investment costs cut its margins forecast and is down 1%.

More on the day ahead after the 8:30 durables data.

Risks of Recession On The Rise

Monday, November 27, 2006

December CBOT Gold

An UNeventful Day In Some Respects

A little before the close we sold our Apple (AAPL) Dec90 puts at a 58% gain and our Dec12 VIX calls for a gain of 25%. The price action in AAPL was lousy heading into the close and we anticipate further pressure on the stock, at least for the early part of tomorrow as a normal correction takes hold. We sold our put position today and locked in a nice gain knowing full well that AAPL is a market darling with almost a cult like following. Longer term negative bets against AAPL have proven fatal to many, but it was worth a quick downward nibble today.

Dell, Yahoo and EMC are Takeover Targets?

Mid Afternoon Market Comment

We initiated a put position in Apple (AAPL) earlier this morning and are presently sitting on a gain of about 50%. We stand at the ready to sell before the close. I have nothing against Apple per se, it will likely perform well going into earnings, but following its huge run (with that tell tale parabolic look on the chart), it should come as no surprise that it would run into a bout of profit taking especially on a down day for the overall market. At some point soon, the stock will likely cross the $100 mark, but not before some healthy consolidation.

Here's a 5 day Apple chart... classic double-top.

IF there is a final hour scamble in the overall market for the exits ahead of economic data this week, the $89.00 level could be tested today.

IF there is a final hour scamble in the overall market for the exits ahead of economic data this week, the $89.00 level could be tested today.We also picked up calls tied to the Volatility Index (VIX) since the market has become, well... more volatile. The VIX Dec12 calls are also up around 40% at this point, and we may take a quick profit before closing.

Gold is trying to get back to the overnight highs, now back above the $641 level. We're still looking for a run toward $645 as the dollar continues to struggle.

Apple - Think Raises Target to $110

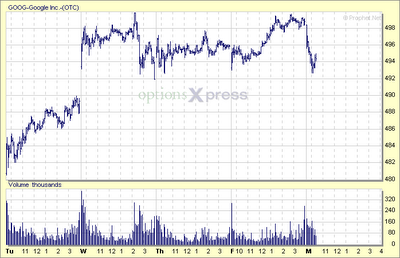

GOOG - we were finally stopped out of the Dec510 calls. We'll come back another day.

Natural Gas - I put a tight stop in this morning and it was taken out for what ended up being a small loss - in at $8.28 and out at $8.25 (a loss of about $150 per contract). I just didn't like its inability to hold above $8.35 and crude oil's inability to hold above $60.

Retailing Winners and Losers

BMUR has cut Aeropostale (ARO) to a SELL noting that the retailer has already resorted to 50% off sales to boost traffic.

Over at Wachovia, sales are exected to be above plan at AEOS and TJX. GPS and ANF appearing to have come up short.

One thing is certain, retailers as a group look droopy today and we'd be inclined to stay away both from long or short bets at this point.

11/27/06 Morning Market Comment

The biggest problem for the buck is expectations the housing bust on this side of the Atlantic will slow the U.S. economy enough to force Helicopter-Ben and the gang at the Fed to cut interest rates early next year, while the ECB lifts rates further to cool Euroland economic growth. That would tilt money flows more in the direction of European assets. Last weeks comments by a VP, ok really THE VP at the People Bank of China, are also a burgeoning and negative reality. Remember, no Central Bank is going to admit to ‘selling’ dollars. They merely have to wink, insinuate, or just blurt out their desire to load up on less U.S. treasuries through ‘diversification’ – and voila, that’s enough to pressure the greenback. With our current account deficit what it is, overseas investors like the Peoples Bank are needed to buy as much U.S. paper as possible to fund the American debt fixation.

The dip in the dollar gave gold a boost overnight, but the metal has since moved back to about unchanged to a bit lower as traders await further dollar cues. The $640 area remains a major area of resistance. We continue to hold the December gold contract.

A plethora of economic data this week will play a big role to either enhance bearish dollar sentiment through weak data, or providing fuel for a relief rally on stronger data. A barrage of numbers are on the way: durable goods (+5%), consumer confidence (106.4), October existing home sales (6.2 mln), revised GDP (1.8%), jobless claims (315k), consumer spending (.1%), Chicago PMI (55), construction spending (unch), and November ISM (52.2).

Stock futures are soft as energy prices move higher. There's speculation that the OPECers will resort to another production cut to keep the price of crude supported. Colder weather is forecast in the northern tier of states by the end of the week. Our trade in natural gas is doing quite nicely this morning. Wal Mart with its forecast over the weekend of a slight decline in same store sales this month is also a negative on sentiment this morning. Wal Mart is down about 1% and a host of others are also trading lower. We were up in Bennington, VT over the weekend and paid a visit to a WMT store on Friday evening, and it was quiet with plenty of 32" and 42" HDTVs sitting at the front of the store.

GOOG is down another $4 in pre-market and we won't be surprised if we get stopped out this morning, but through other options and futures trades, the speculative/trading portfolio is up 54% over the past week, so we'll take the loss in GOOG and move on IF that's what happens this morning. A disciplined approach with respect to trading anything is essential but especially with leveraged assets likes options and futures. This means a stop loss level must be determined at the time of trade and the loss taken if the stop is hit.

GM shares are up 2-cents, but the longer term trend doesn't look good. The Journal devotes ink ink this morning to the travails of the auto industry with no end in sight thanks in part to the housing bust.

The Heard on the Street column (by subscription) of the Wall Street Journal takes aim at makers of drug coated stents: Johnson & Johnson (JNJ), Boston Scientific (BSX) and Abbott Laboratories (ABT). The column says the FDA will be holding safety hearings next month, something that is spooking investors as the hearings get closer. The stents have been increasingly blamed for causing heart attacks due to heightened risk of blood clots.

Sunday, November 26, 2006

December CBOT Gold Update

Thanks For Stopping By!

Jan Natural Gas - e-minNY

Friday, November 24, 2006

December CBOT Gold

Neurochem (NMRX)

Getting my attention is the May options volatility which has surged to 133! Tramiprostate may eventually offer some hope to patients with mild to moderate Alzheimers disease. For now, it's an expensive lottery ticket in the options world, but a development worth watching. The options market has certainlyu taken notice.

11/24/06 Morning Market Comment

The dollar, in the meantime, continued to fall against the Yen and Euro on concerns the U.S. economy is slowing. The dollar woes gained a head of steam earlier this week following a larger than expected rise in jobless claims. Indeed, the dollar index (DXY) chart is looking very ugly:

The Euro surged to $1.30 for the first time since April 2005. There is also speculation that the ECB will continue to lift interest rates next year; that narrows the differential between the Euro and the buck, making the Euro look more appealing. The premium on U.S. government bond yields has also narrowed to the lowest level in about a 1-1/2 years further attracting investors into Euroland assets.

Quite frankly, the dollar's slide over the last week has almost been 'disorderly' and it's spooking the stock market. The only hope for the bulls is that thin holiday trading has exacerbated the dollar's decline and that there will be a rebound attempt in earnest when normal trading resumes next week. As the bloody debacle in Iraq gets worse and the dollar slides, the stock market is poised to break the positive Thanksgiving week tradition and not only open lower this morning, but potentially end lower for the week if it doesn't bounce off of this morning's lows.

Last night we picked up a position in the 100 oz. CBOT December gold contract (ZGZ6) in response to the recent dollar breakdown (a weaker dollar can spur inflation since it makes overseas goods more expensive). Each 10-cent move in gold translates into a $10 move in each contract's value, so we're sitting on a substantial gain with a $10 rise in the price of the metal this morning. $640 on the chart beckons again, but it will be a tough resistance area. The intraday technicals will need to be looked at carefully today to determine if I let the position ride through the weekend, or if I sell before the end of the day today to lock in gains. This may be the day we break $640, but then $645 stands as a roadblock. Stay tuned.

Demand for the metal by way of the streetTRACKS gold ETF (GLD) has been so strong that the streetTracks gold holding has vaulted past 418 tons! We realize that buyers of streetTracks have been well supplied lately by Central Bank gold selling, but with a declining dollar, our confidence is growing that gold will make a run back toward the $680 level over the course of the next three months as the picture sours further for the buck.

One other gold note: CBOT electronic gold is trading today while COMEX is closed... that's a first and isn't it ironic that this first is happening on a day $10 up day for gold.

While we very much like the chart condition of Google (GOOG), if we get stopped out at $500 in a weak stock market today, so be it. We can always come back another day to pick up the GOOG Dec510 calls. GOOG is down over $3 bucks in the early going.

Thursday, November 23, 2006

Gold Has Our Attention Again

Which Retailing Stock Should I Buy?

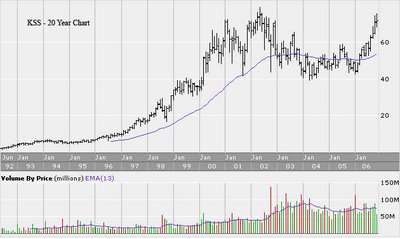

While there may be plenty of momentum left to enable JCP to break historic resistance and make a run for the $100 mark, for me, every $1 made above that resistance would have been a dollar made with worry attached to it which is just not worth it.

The 20 year chart for KSS shows the same problem of bumping up against major, multi-year resistance:

KSS, by the way, was one of the few retail laggards on Wednesday, falling by more than 1%. Money also rotated out of ANN, CBK, CWTR (big earnings miss), CHS and BDOG. Sears Holdings (SHLD) was the biggest winner Wednesday with a gain of almost 3%. I will have more on SHLD in a separate post.

The chart of Nordstrom shows a similar pattern of amazing returns and begs the question of, “why jump into these names now??”:

I have no doubt that with services like TheStreet.com touting these stocks, the crowd will jump in, but I’m not comfortable following the lemmings… err, the crowd. Sure, names like JCP, JWN, KSS could be seen as positive-trend-is-your-friend plays, and that there’s always the chance that the season will surprise to the upside (consumers are a clever bunch when it comes to finding extra spending money); but I’m going to keep the powder dry where the major retailers are concerned. I will revisit this stance when I see the same store sales data for November next week.

Some Food For Thought

Dear Readers,

Dear Readers,U.S. markets are closed today. Aside from tomorrow’s scheduled half day of trading in the stock market, most U.S. markets will remain closed until Monday morning. We get to enjoy a long holiday weekend courtesy of President Abraham Lincoln who in 1863 set aside the last Thursday of November “as a day of Thanksgiving and Praise to our beneficent Father who dwelleth in the Heavens.” FDR had Congress change Thanksgiving to the present 4th Thursday of November. For the entire Lincoln Thanksgiving proclamation Click here.

Little did Lincoln realize, but his proclamation would spur the Swanson brothers to invent the TV Dinner 90 years later. The true tale is told here at this amazing link. But let's hope you're having home roasted turkey today.

Happy Thanksgiving!

Happy Thanksgiving!

Wednesday, November 22, 2006

Brocade December8 Calls

GOOG December Calls

Kirk and MGM

Dollar General - Takeover Chatter

FCX and BHP

11/23/06 Morning Market Comment

Another winner on the earnings gravy train: Brocade is trading over 6% higher at over $9/shr. PACS has raised its target to $12 from $10 and keeps BRCD as a "top pick". Brocade has been upgraded at NEED to BUY from HOLD with a $10.50 price target. Needham says it is more positive about the company's outlook and execution after yesterday's storng results.

J Crew (JCG) is up better than 8% on strong earnings; CWTR on the downside after earnings, lower by 4-1/2%

Google (GOOG) remains a market darling, up another $3 in pre market activity. JEFF notes that option implied volatility on GOOG is only 29, at the low end of its historical range. JEFF also notes that even above $500, GOOG is trading at 22x fiscal-07 EDITDA also within its historical range, though certainly not cheap.

The Heard On The Street column of the Wall Street Jounral devotes ink this morning to takeover speculation. It's not IF, but WHO? The column says Sprint-Nextel (S), Hilton (HLT), Lennar (LEN), Ryland (RYL), D.R. Horton (DHI) and ServiceMaster (SV) could be ripe for the picking. But the columns cautions, “But investors shouldn't get carried away betting on possible takeovers. Not only are they tough to predict, these deals also are somewhat less lucrative than they once were. The average premium paid over market prices for shares of companies subject to an acquisition bid this year is 17%, down from 25% in 2000, according to Thomson Financial.” Details here (subscription required): http://online.wsj.com/article/heard_on_the_street.html?mod=djemheard.

Speaking of takeover talk, US Steel (X) remained strong yesterday… even Nabors (NBR) held on to a bid despite a spokesman, on Monday, saying takeover rumors were “unfounded”. There is also over the top speculation that BHP could be mulling a takeover of Freeport McMoRan (FCX), though Freeport has agreed to acquire Phelps Dodged (PD). It’s over the top, but nowadays you just never know.

Stock futures are higher across the board boosted by strong earnings and ongoing takeover speculation. As the equity only put to call ratio and volatility measures continue to slide there's certainly a whiff of an overbought and complacent condition in the market, but the picture still remains fairly bullish.

NYMEX floor trading is closed for the rest of the week. EIA data will be out later in the morning. Analysts are guessing crude stocks will rise by 700k/bbl and drops of 750k in mogas and by 1.1 mln/bbs in distillates. EIA nat gas inventory data will also be out a day early, and a withdrawal of 3 to 7 Bcf is expected. In electronic trading this morning, Jan WTI is down 24-cents. Cold is trying again, up $1.80 at the $630 mark.

Tuesday, November 21, 2006

Google Insiders Dumping LESS Shares

Trading the Thanksgiving Market

Here's a wrap up of today's market courtesy of our favorite financial site, WSJ.Com. In this write up, some interesting perspective on how Thanksgiving weeks are generally UP weeks for the U.S. stock market (subscription required): http://online.wsj.com/page/2_0064.html?mod=2_0064

Here's a wrap up of today's market courtesy of our favorite financial site, WSJ.Com. In this write up, some interesting perspective on how Thanksgiving weeks are generally UP weeks for the U.S. stock market (subscription required): http://online.wsj.com/page/2_0064.html?mod=2_0064

Brocade (BRCD) Beat the Street Again

BRCD 4th quarter earnings amounted to 14c vs. consensus estimates of 12c. Revenue of $208.8 mln vs. consensus estimates of $203.51 mln. BRCD moved higher AH which should enable us to take a profit at some point tomorrow morning on the BRCD calls.

BRCD 4th quarter earnings amounted to 14c vs. consensus estimates of 12c. Revenue of $208.8 mln vs. consensus estimates of $203.51 mln. BRCD moved higher AH which should enable us to take a profit at some point tomorrow morning on the BRCD calls.Dell managed to beat by a big 6c a share and the stock has moved past the $27 level. As noted earlier, we stayed off to the sidelines this time around... better to be a chicken than a dead duck.

Another earnings winner this evening is J Crew (JCG) posted earnings of 27c, a full 6c above estimates.

Google (GOOG) finished just a touch below the highs of the day and we will continue to hold our December calls until the momentum either grinds to a halt, or we see a blow off near term top on volume of 12 mln shares or more. Today's volume totaled 8.4 mln.

Quick Crude Comment

Brocade (BRCD)

Interdigital Comm (IDCC)

Enzon (ENZN)

Dell - We're NOT In

The battle lines are certainly drawn. In the December options, 42k Dec 25 calls have traded vs volume of 18k puts. Open interest on the Dec25 calls also out numbers OI on the puts by 16k contracts. Given that implied volatility is about its long term average, both sides may get little satisfaction unless there is a huge surprise which is not factored into the pricing of the options.

Google Over $500 - We're In

Dell Computer (Dell)

11/21/06 Morning Market Comment

Shares of John Deere (DE) are down about 3%. While earnings beat street estimates, DE say's "equipment sales are projected to be roughly flat for the full year and increase approximately 5% for the 1st Q of 2007".

Among top-5 stocks/indexes with high put/call ratios yesterday:

Tyson (TSN), Consumer Discretionary (XLY), WW Grainger Inc (GWW) and Ameriprise Financial (AMP).

All in all, it's likely to be another less than magnamimous day on Wall Street, but as long as the bulls can keep the major indexes moving along that narrow upward channel we talked about yesterday, the case remains modestly bullish.

It's Time For... Faaaaamilllllyyyyyy Feuuuuuddddd

No wonder Sumner Redstone has no tolerance for actors who jump up and down on Oprah's couch. This guy has some big family problems on his has hands. Where's Richard Dawson when we need him most? (subscription required): http://online.wsj.com/article/SB116404249182028499.html?mod=home_whats_news_us

No wonder Sumner Redstone has no tolerance for actors who jump up and down on Oprah's couch. This guy has some big family problems on his has hands. Where's Richard Dawson when we need him most? (subscription required): http://online.wsj.com/article/SB116404249182028499.html?mod=home_whats_news_us

Monday, November 20, 2006

So, There Is Still A Little Decency Left

(by subscription): http://online.wsj.com/article/SB116405450775128696.html?mod=home_whats_news_us

This leads me to wonder why Newscorp thought it could get away with this in the first place. Could they really have been caught so off guard by the firestorm of criticism directed toward "If I Did It"? If so, they are a bunch of dolts - from Murdoch on down.

I also can't help but to wonder whether the entity that was paid the $3.5 mln by the Regan imprint of HarperCollins for the book gets to keep the $3 mln? Perhaps O.J. misses out on another 15 minutes of fame with his book being pulled, but his family, or whomever was going to reap the financial rewards of the book may still end up quite a bit wealthier.

And one other question, what happens to all of the copies of the book now sitting in warehouses? At least 200,000 copies had to have been printed for next week's release. If there ever was a good reason for a mass book burning, "If I Did It" would be it.

More Cracks In The Housing Market

But have no fear, your favorite economist more than likely thinks the worst is over for the housing bust (subscription required): http://online.wsj.com/article/SB116370236302025327.html?mod=djemalert

For reasons previously stated, I'm in the camp who believes housing won't bottom until 2008. Is there anyone who would seriously argue that economists as a group aren't a contrary indicator? LOL.

GOOG and $500 - Not So Fast

X - U.S. Steel

11/20 Morning Comment

Merger mania whether across transatlantic time zones with the Nasdaq bid, or in the merger-hot mining sector, or by way of the ongoing LBO's (more than $3 trillion worth this year) can only serve to support the stock market even as ominious housing meltdown storm clouds develop on the horizon. This chart of the S&P 500 illustrates a bullish upward channel - the 'trend remains your friend' - for now.

Futures are on the soft side this morning, following a modestly positive Friday expiration. Put to call ratios remain low (though 2 mln Wynn calls that traded Friday on a dividend capture play have distorted the picture) and the VIX continues to flirt with all time lows. That low VIX isn't necessarily a good thing since it indicates dangerously low complacency that will eventually be resolved in probably a not so happy way for the bulls. PD in pre market trading is up $27 at $121, while FCX is down only $4. EOP is up by better than $3

Futures are on the soft side this morning, following a modestly positive Friday expiration. Put to call ratios remain low (though 2 mln Wynn calls that traded Friday on a dividend capture play have distorted the picture) and the VIX continues to flirt with all time lows. That low VIX isn't necessarily a good thing since it indicates dangerously low complacency that will eventually be resolved in probably a not so happy way for the bulls. PD in pre market trading is up $27 at $121, while FCX is down only $4. EOP is up by better than $3

.

My holding in X calls may benefit from another $2+ early rally in shares of U.S. Steel on steel industry merger speculation which is turning white hot. The catalyst for further upside in shares of steel today is the $2 bln takeover of Oregon Steel Mills by Russia's Evraz Group. Who's next? X, NUE, CHAP, STLD??

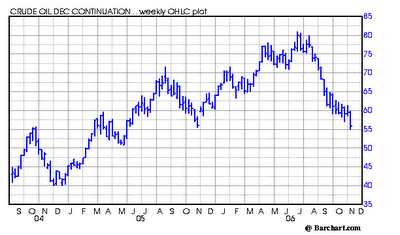

WTI is modestly lower, and this is where I will continue to focus the bulk of my trading activity this holiday shortened week. The large specs are now bullish for the first time since October, but even with the implied bullishness the December contract still went off the board at its lowest since the summer of 2005.

Gold is up about $2, but I continue to stay away until I see a further breakdown in the dollar and I become bullish on crude.

Sunday, November 19, 2006

More Pre-Monday Musings

In the ever merger-hot mining industry, Phelps Dodge (PD) is Freeport-McMoRan's (FCX) to have and to hold for the price of $25.9 bln in cash and stock. Phelps is being taken out at $126/shr vs its Friday closing price of $95. Trading in PD call options was moderate at about 9,000 contracts for the December strikes.

In another whopper of a deal, The Wall Street Journal reports Blackstone is set to annonce a takeover of Equity Office Properties (EOP) for $20 bln, or $48.50/sh. That's about a 10% premium to Friday's closing price. Call options trading in EOP was fairly quiet on Friday, with only about 600 December calls trading - 522 were the December 45s.

The ongoing activity of competitors gobbling each other up and private equity firms willing to pay decent premiums to take companies private continues to be a large factor in the 'bullish column' for investors to be mindful of.

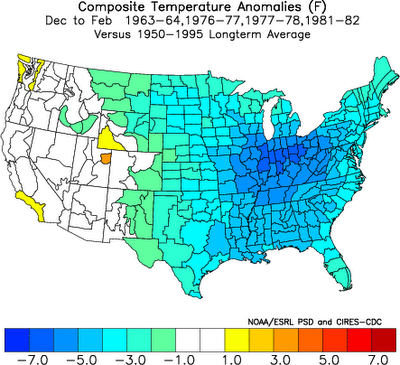

It's only 7 p.m. eastern time, but crude oil is off to a lower start with the Jan contract down a-half percent, or 29-cents/bbl. Natural Gas is down .8%. In the near term, there's more reason to be bearish than bullish - the chief factors being plentiful supply both in all strata of the barrel market and in underground natural gas storage; mild northeast temps relative to norms; and no immediate prospect of mushroom clouds being seen over the Middle East. So my bias and approach toward trading crude oil futures will be a continued bearish mindset, but being ever mindful of emergent, or nascent bullish factors like geopolitical events and a swing toward a colder direction for the winter season (at some point). Thus far, temps are looking great if you like it on the milder side. The operational GFS is predicting high temps in NYC to remain above 40f through December 3rd! This will continue to be a bearish influence on the energy markets. But here's something else to consider:

The above is a composite of how aggregate winters turned out following fall seasons with a mild/moderate El Nino: cold winters. This stuff isn't perfect, of course, but it's a reminder backed by past data that a surprise turn of events may occur to catch those off guard who are expecting another above average winter and the bearish impact on the energy markets to continue through the winter.

Saturday, November 18, 2006

Thanksgiving Week

Monday and Tuesday will be the only normal trading days of the week; by midday Wednesday much of the crowd will be clearing out of lower Manhattan in preparation for Thursday’s overdose of tryptophan also known as Thanksgiving Day. Trading resumes on Friday – retailer Black Friday – but the day after Thanksgiving is traditionally among the slowest trading days of the year since the market is only open a half day.

Monday and Tuesday will be the only normal trading days of the week; by midday Wednesday much of the crowd will be clearing out of lower Manhattan in preparation for Thursday’s overdose of tryptophan also known as Thanksgiving Day. Trading resumes on Friday – retailer Black Friday – but the day after Thanksgiving is traditionally among the slowest trading days of the year since the market is only open a half day.Concerning this coming Friday and what it means for quick trading opportunities in the big retailers: Not a heck of a lot IMO. From what I’ve observed over the years, long lines at 5 a.m. on the Friday after Thanksgiving and big crowds at those stores on that day are routine and bad justification to run home and load on up options. The better retailer related trading opportunities come the following week and into the first week of December when the picture becomes clearer as to just how bad or good the season started off. It's all about comparable store sales, or COMPS and that data won't be out until more than a week after Black Friday. If anything, that bunch who lines up at 5 a.m. the morning after Thanksgiving to trample each other while scampering in to grab the $200 p-c, or the $99 36” t.v. are there for the dirt cheap, low margin bargains which run out of stock by noon on Black Friday.

With Wal Mart’s (WMT) back against the wall because of its weak same store sales growth in recent months, the retailing giant is taking a page from Mr. Sam's rules of selling and is already heavily discounting to pull more shoppers in; that has put everyone else on the defensive. WMT is determined to get as much of the 350-billion dollar holiday shopping sales pie as possible. In the options universe sentiment is biased toward the upside. In the December options, open interest totals about 87,000 puts vs 120,000 calls.

The economic calendar in the coming week is pretty quiet aside from LEI on Monday and jobless claims and Michigan sentiment on Wednesday. EIA will also be releasing its usual batch of inventory data.

Here are some potential options plays that I will be keeping an eye on:

Google (GOOG) at 500. The $64 question is will it not only cross $500, but can it make a decisive move past that high water mark? GOOG got within about half-dollar of touching $500, but just couldn't muster enough strength on expiration Friday to take out the strike. Open interest on the December 500 calls total 13,511 vs open interest of only 2600 contracts in the 500 puts. What I'm really waiting for is strong volume. In the surges past both 400 and 450 volume was exceedingly strong (6 mln+). If we come out of the gate with heavy volume and positive momentum on Monday, I will jump into the December 510 calls, BUT GOOG has been known to flirt with century marks in the past, and there's no assurance that next week will be the week to stock breaks through 500.

Amgen (AMGN) December 75 calls. There was interesting action there on Friday. Over 13-thousand traded vs previous day open interest of 8,909.

The Housing Meltdown

Nerds Gone Wild - PS3

Sony is said to be losing $300 for each PS3 sold: http://news.portalit.net/fullnews_Sony-Loses-$300-For-Each-Sold-PlayStation-3,-Say-Researchers_2224.html.

But the real losers are the folks who are selling their PS3s on eBay. What looks like a great flip - from Wal Mart shelf to the hands of an anxious eBay buyer - doesn't look so good if you consider the time spent in getting the unit. Think of it this way: Many PS3 sellers on Ebay are claiming to have spent upwards of 60 hours waiting in line at Wal Marts, Targets and Best Buys to have first dibs on the limited inventory item. That's the equivalent of working a week and a half of eight hour shifts. Let's say one of the folks on that line makes $10/hr; 60 hrs on line works out to $600 worth of time camping out in a parking lot (for some of those guys that's probably still better than working for a boss). With final selling prices for the 60gb version of PS3s hovering at $1400 on eBay - the $650 cost for the unit works out to a gross profit of $750. But it's down hill from there. When you factor in $600 worth of time spent waiting to get the PS3, the profit is whittled down to just $150; and don't forget to add in eBay selling fees and Paypal fees to subtract another $78. Net profit ends up being just $72.

But the real losers are the folks who are selling their PS3s on eBay. What looks like a great flip - from Wal Mart shelf to the hands of an anxious eBay buyer - doesn't look so good if you consider the time spent in getting the unit. Think of it this way: Many PS3 sellers on Ebay are claiming to have spent upwards of 60 hours waiting in line at Wal Marts, Targets and Best Buys to have first dibs on the limited inventory item. That's the equivalent of working a week and a half of eight hour shifts. Let's say one of the folks on that line makes $10/hr; 60 hrs on line works out to $600 worth of time camping out in a parking lot (for some of those guys that's probably still better than working for a boss). With final selling prices for the 60gb version of PS3s hovering at $1400 on eBay - the $650 cost for the unit works out to a gross profit of $750. But it's down hill from there. When you factor in $600 worth of time spent waiting to get the PS3, the profit is whittled down to just $150; and don't forget to add in eBay selling fees and Paypal fees to subtract another $78. Net profit ends up being just $72.This little exercise in the value of time is likely just a waste of time since anyone who would live in a parking lot for 60 hours probably doesn't view their time and effort as being worth much to begin with.

If I spent all that time outside a China Mart... err, Wal Mart, I would enjoy the PS3 and not flip it like it was stock from a hot IPO.

By the way, the numskull (literally) who managed to slam his face into the flagpole in the above video link was probably unaware of a really awesome feature of PS3 that goes beyond the realm of playing games - Blue Ray video disc technology. When played on a 1080p television display, Blue Ray makes conventional DVDs look like muddy, 5th generation VHS. But this blogger has it right concerning Blue Ray... it's a huge gamble that Sony is making: http://ce.seekingalpha.com/article/20772

Amid the hoopla over both PS3 and Sony Pictures' new Bond film, ADRs of Sony nudged 2% higher on Friday. From an investment standpoint, many may end up wondering, "Is that all there is?" The Sony stock chart with its series of lower highs and lower lows looks terrible:

There are no BUY ratings from analysts who cover SNE, 10 HOLDS and a combination of 11 SELLS and STRONG SELLS, acccording to data from the Jaywalk Consenus. The Street basically hates the stock and with major resistance on the chart showing at about $47 and a larger double top near $52 SNE looks like dead money. For Sony's sake, let's hope PS3s don't start bursting into flames like their computer batteries did.

Friday, November 17, 2006

Double Nickels

For the past week, the December WTI contract, which expired today, slid 6%.

Interestingly enough, the January contract finished the day higher by 40 cents to $58.97 a barrel, for about a $3 premium to December. The overall contango has remained remarkably wide across the barrel market, and a $3 premium for January delivery indicates the expectation, at least as of today, that OPEC may be able to get its act together and reduce production and that colder weather might actually set in by January. The EIA numbers that caught my eye earlier in the week were imports running below 10 MMbbl/d for two consecutive weeks, providing at least scant anecdotal evidence that the OPECers are trying to reduce output.

IF seasonably cold temps emerge by the end of December and a real effort by OPEC to slice output materializes that would certainly enable WTI to make a run back into the low 60's. But the jury is still out and with the technical damage seen in the December contract this past week, this time frame with the OPEC and weather questions still up in the air, may be the best chance yet the bears have to pierce $55 and make a run for $50.

Incidentally, the latest Commitments of Traders report shows a fairly even keel of short Commercials vs longs with 742,030 long and 741,315 short. Non commercial shorts dropped by over 28,000 contracts to 147,904 vs 165,257.

In the week ahead, While my bias remains fairly bearish on crude, I am going to continue to go with the flow via eMini contracts either by selling them short, or as I did today, taking a long position off the intraday low. I will continue to open and close out futures positions in both crude and natural gas on a day to day basis. With the Jan contract at $58, I am ready for trading parameters similar to the recent action in the December contract: $55 area to the downside; $62 to $63 to the upside, at least until fundamentals like OPEC and the weather become clearer.

X - Marks the Spot?

Russian steel company Severstal may be planning a series of transactions which would culminate in a bid for U.S. Steel, according to a report in a Russian newspaper. The report touched off a a huge rally in shares of X.

Russian steel company Severstal may be planning a series of transactions which would culminate in a bid for U.S. Steel, according to a report in a Russian newspaper. The report touched off a a huge rally in shares of X.What really got the froth going was a non denial from a U.S. Steel spokesman: "We favor consolidation if it builds value for our shareholders, but we don't discuss any actions we may or may not be taking until the appropriate time." Of course, that comment was really a 'no comment'; but the lack of a categorical denial spurred shares to a gain of more than 9%.

The X rally was seventh heaven for holders of expiring November call options with strikes at 70 and below. The Nov70's opened worthless, but finished the day at 50-cents bid on open interest of over 17-thousand contracts -- a simply stunning resurrection from the dead for those options holders. Even November 65 call holders were saved from doom by today's rally.

I'm usually not one to chase takeover rumors, but this one intrigues me given the merger activity in the overall sector; that Severstal has been left at the altar and denied before; and what appeared to be heavy institutional participation today both in large underlying stock volume and options volume. Across the entire X call options chain, 85,000 traded today; that's 8-times the daily average.

Since this is all takeover speculation at this point, I've taken just a 1/4 position in the December 80 calls with the purchase of 40.

The play in the week ahead for X will be one of sector momentum amid consolidation in the sector. Will an X takeout by the Ruskies really happen? Wouldn't Congress and the Department of Justice love that! Time will tell.