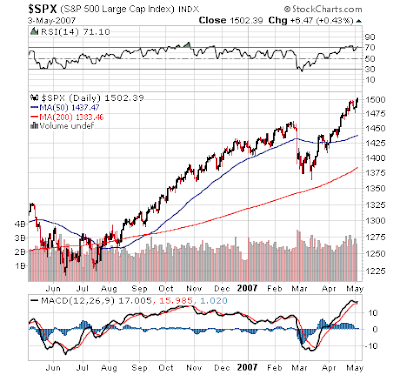

For the first time since 2000 the S&P 500 has managed to trade above the 1500 level which leaves it just 2% away from its 2000 record closing high of 1527 and 3% away from its 2000 intraday high of 1553. Unless something big blows up in the world, or a real dose of reality hits the market by way of a previously unknown devastating financing disclosure related to the ongoing subprime and Alt-A woes, there's no reason to believe we won't reach the all time closing high, or even the intraday high on the S&P given the momentum and strength of the present move. A key catalyst - earnings - will be dying down once Cisco Systems (CSCO) posts earnings next Tuesday but there won't be a complete catalyst vacuum since the bulls have a propensity to make positive catalysts out of just about anything.

For the first time since 2000 the S&P 500 has managed to trade above the 1500 level which leaves it just 2% away from its 2000 record closing high of 1527 and 3% away from its 2000 intraday high of 1553. Unless something big blows up in the world, or a real dose of reality hits the market by way of a previously unknown devastating financing disclosure related to the ongoing subprime and Alt-A woes, there's no reason to believe we won't reach the all time closing high, or even the intraday high on the S&P given the momentum and strength of the present move. A key catalyst - earnings - will be dying down once Cisco Systems (CSCO) posts earnings next Tuesday but there won't be a complete catalyst vacuum since the bulls have a propensity to make positive catalysts out of just about anything.In addition to a climb above 1500, the SOX recaptured the 500 level today. And not to be outdone, the Wilshire 5000 closed at an all time high today at above the 15,000 level.

It all makes sense to me. For as long as the liquidity hose remains at full blast and can contain a plethora of problems this market is likely to remain strong - that is until even the liquidity hose fails to contain some sort of out of control fire.

No comments:

Post a Comment